For the 24 hours to 23:00 GMT, the AUD declined 11.24% against the USD and closed at 0.6128.

LME Copper prices rose 0.7% or $34.0/MT to $4,797.0/MT. Aluminium prices declined 0.4% or $6.0/MT to $1,489.0/MT.

In the Asian session, at GMT0300, the pair is trading at 0.6130, with the AUD trading slightly higher against the USD from yesterday’s close.

Overnight data showed that Australia’s AiG performance of manufacturing index climbed to 53.7 in March, compared to a level of 44.3 in the previous month. Moreover, seasonally adjusted building permits jumped 19.9% on a monthly basis in February, more than market expectations for a rise of 4.5%. In the prior month, building permits had recorded a revised drop of 15.10%. On the other hand, Commonwealth Bank manufacturing PMI dropped to a level of 49.7 in March, compared to a reading of 50.1 in the prior month.

Separately, the Reserve Bank of Australia (RBA), in its latest monetary policy meeting minutes, indicated that members do not favour negative interest rates and it is likely that the cash rate would remain at a very low level for an extended period. The central bank cautioned that the economy would witness a “very material contraction” due to coronavirus and could potentially continue beyond the June quarter. Also, officials indicated that there would be significant job losses over the months ahead.

Elsewhere, in China, Australia’s largest trading partner, the Caixin manufacturing PMI climbed to 50.1 in March, more than market anticipations and compared to a level of 40.3 in the previous month.

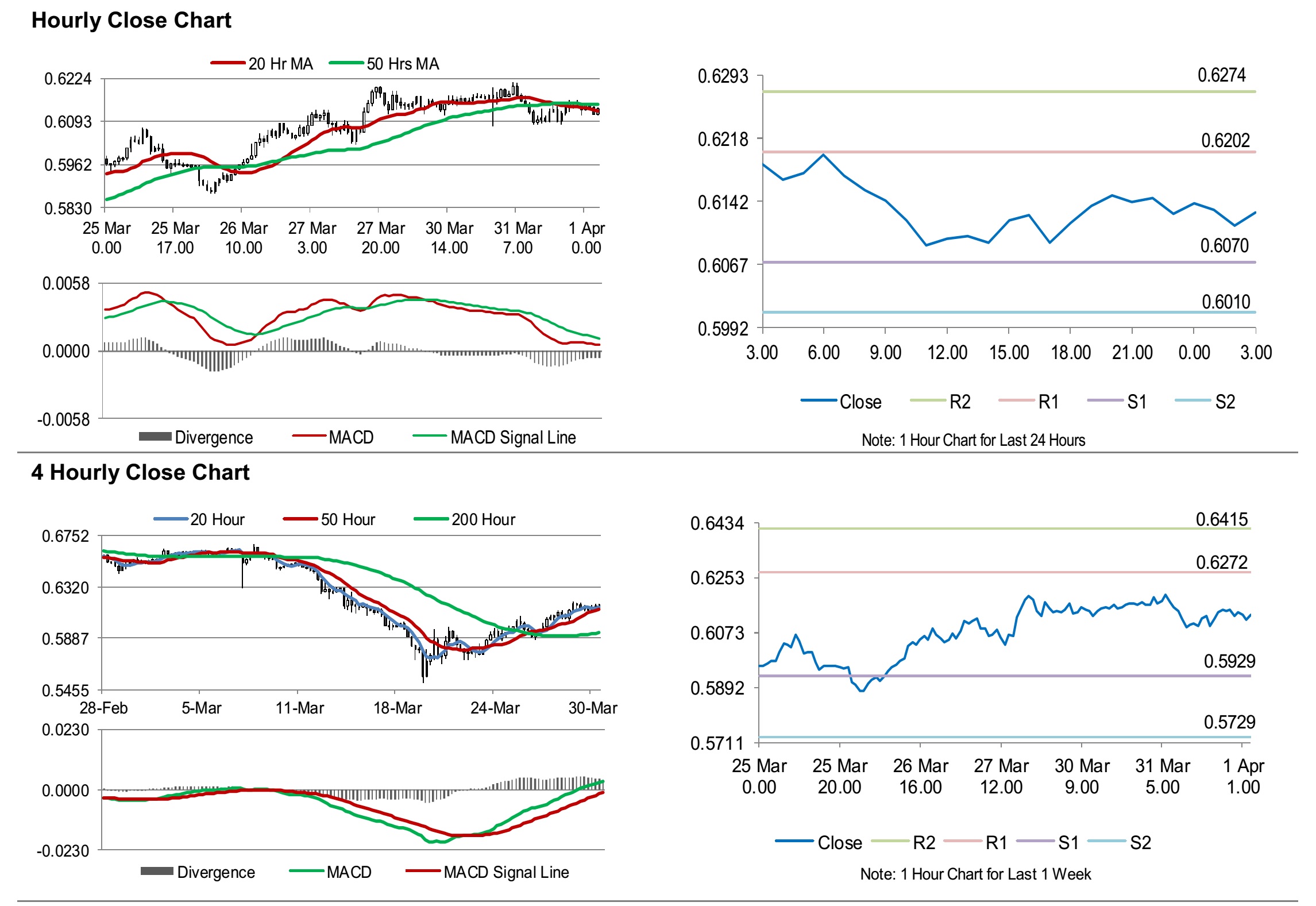

The pair is expected to find support at 0.6070, and a fall through could take it to the next support level of 0.6010. The pair is expected to find its first resistance at 0.6202, and a rise through could take it to the next resistance level of 0.6274.

The currency pair is showing convergence with its 20 Hr moving average and trading below its 50 Hr moving average.