For the 24 hours to 23:00 GMT, the AUD declined 0.40% against the USD and closed at 0.6875.

LME Copper prices declined 0.1% or $6.5/MT to $5943.0/MT. Aluminium prices rose 0.4% or $7.0/MT to $1781.5/MT.

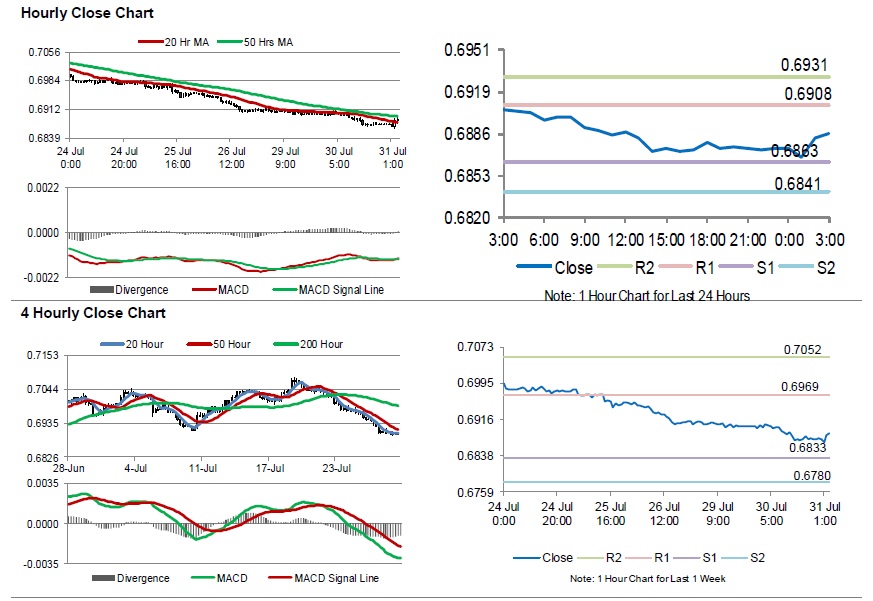

In the Asian session, at GMT0300, the pair is trading at 0.6886, with the AUD trading 0.16% higher against the USD from yesterday’s close.

Overnight data showed that Australia’s consumer price index (CPI) advanced 0.6% on a quarterly basis in 2Q 2019, more than market expectations for a gain of 0.5%. In the prior quarter, the CPI had recorded a revised unchanged reading. Moreover, the nation’s private sector credit demand climbed 0.1% on a monthly basis in June, compared to a revised similar rise in the prior month. Markets participants had envisaged the private sector credit to record a rise of 0.3%.

The pair is expected to find support at 0.6863, and a fall through could take it to the next support level of 0.6841. The pair is expected to find its first resistance at 0.6908, and a rise through could take it to the next resistance level of 0.6931.

Going ahead, traders would await Australia’s AiG performance of manufacturing index and the CBA manufacturing PMI, both for July, slated to release overnight.

The currency pair is showing convergence with its 20 Hr moving average and trading below its 50 Hr moving average.