For the 24 hours to 23:00 GMT, the AUD declined 0.24% against the USD and closed at 0.7193.

LME Copper prices declined 0.2% or $13.0/MT to $5501.0/MT. Aluminium prices rose 0.03% or $0.5/MT to $1713.5/MT.

Over the weekend, data showed that in China, Australia’s largest trading partner, the NBS manufacturing PMI eased more-than-expected to a level of 51.4 in December, compared to a level of 51.7 in the previous month, whereas investors had envisaged for a drop to a level of 51.5. Moreover, the nation’s NBS non-manufacturing PMI declined to a level of 54.5 in December, compared to a level of 54.7 in the preceding month.

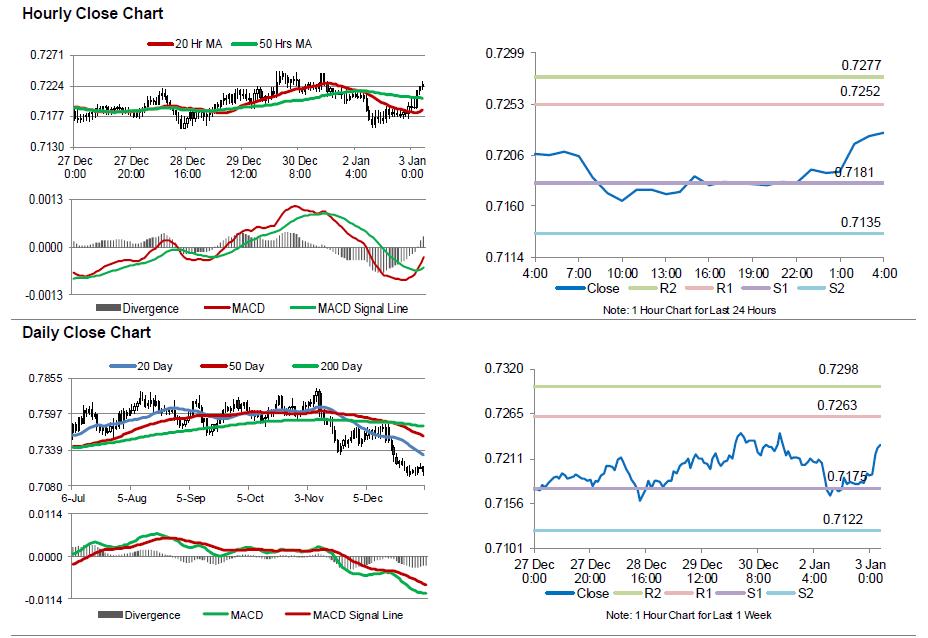

In the Asian session, at GMT0400, the pair is trading at 0.7227, with the AUD trading 0.47% higher from yesterday’s close.

Overnight data indicated that Australia’s AiG performance of manufacturing index advanced to a level of 55.4 in December, expanding for the third consecutive month and rising at its fastest pace since July 2016, thus boosting optimism over the health of the nation’s manufacturing sector. The index registered a reading of 54.2 in the previous month.

Elsewhere in China, the Caixin manufacturing PMI unexpectedly rose to a level of 51.9 in December, marking its fastest rate of growth in three years and further indicating that the world’s second-largest economy is stabilizing. Meanwhile, markets expected the index to record a steady reading of 50.9.

The pair is expected to find support at 0.7181, and a fall through could take it to the next support level of 0.7135. The pair is expected to find its first resistance at 0.7252, and a rise through could take it to the next resistance level of 0.7277.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.