For the 24 hours to 23:00 GMT, the AUD declined 6.78% against the USD and closed at 0.6436.

The Reserve Bank of Australia (RBA), in its interest rate decision, kept its key interest rate on hold at 0.25%, as widely expected. The central bank indicated that it would not increase the cash rate target until progress is made towards full employment and inflation target. Governor, Philip Lowe, stated that the Australian economy is going through a “very difficult period” and hence, the bank remains committed to do what it can to support jobs and economic recovery during this difficult phase.

LME Copper prices rose 1.1% or $53.5/MT to $5,111.5/MT. Aluminium prices climbed 0.1% or $1.5/MT to $1,438.5/MT.

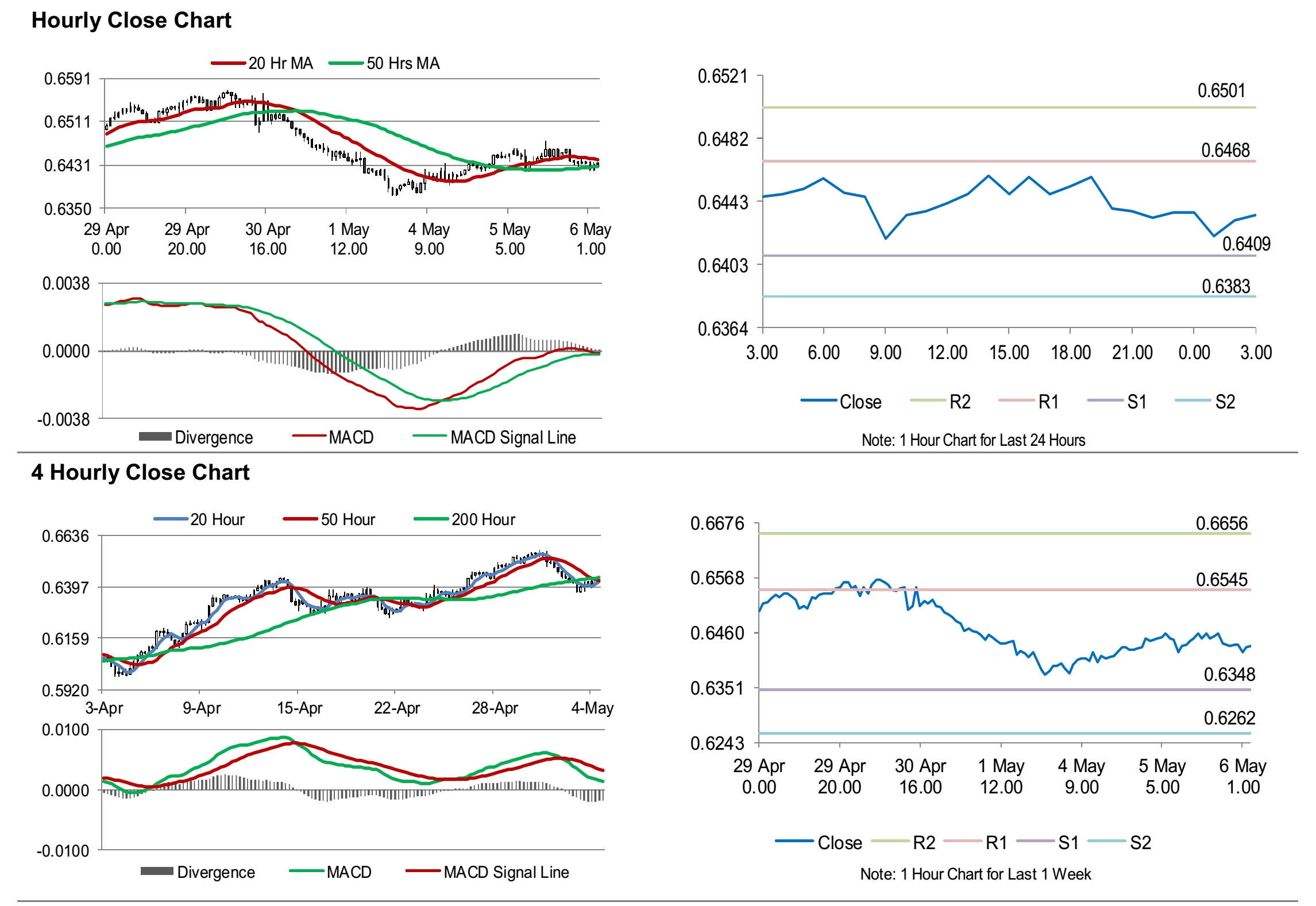

In the Asian session, at GMT0300, the pair is trading at 0.6434, with the AUD trading slightly lower against the USD from yesterday’s close.

Overnight data showed that Australia’s retail sales climbed 8.5% on a monthly basis in March, more than market forecast for a rise of 8.2% and compared to an advance of 8.2% in the previous month.

The pair is expected to find support at 0.6409, and a fall through could take it to the next support level of 0.6383. The pair is expected to find its first resistance at 0.6468, and a rise through could take it to the next resistance level of 0.6501.

Moving forward, investors would keep a watch Australia’s AiG performance of services index for April and the trade balance for March, slated to release overnight.

The currency pair is trading below its 20 Hr moving average and showing convergence with its 50 Hr moving average.