For the 24 hours to 23:00 GMT, the AUD rose 0.39% against the USD and closed at 0.6994, after the Reserve Bank Governor Philip Lowe, in a post-meeting statement, indicated that the monetary policy easing would support employment and the inflation to remain in line with its medium-term target.

LME Copper prices declined 1.5% or $89.0/MT to $5910.0/MT. Aluminium prices declined 0.3% or $22.5/MT to $1755.5/MT.

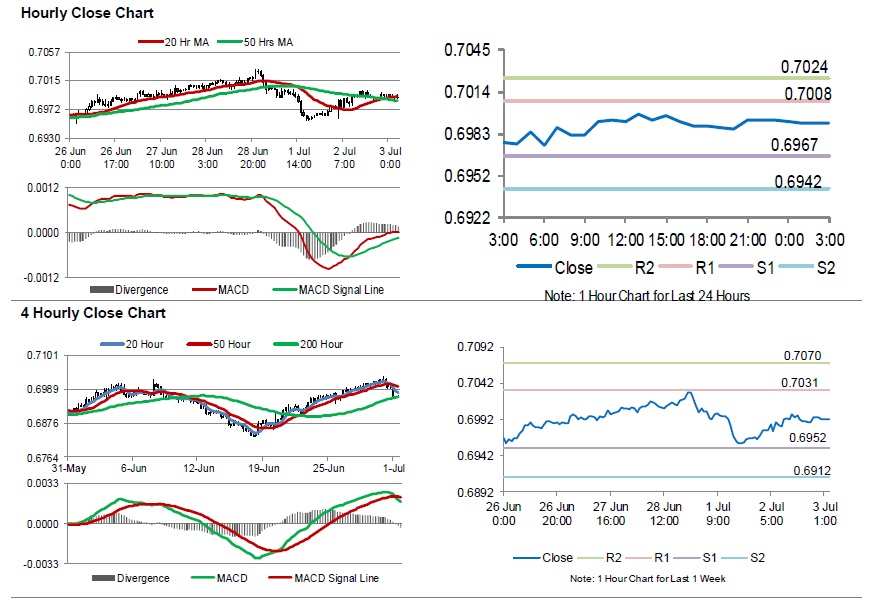

In the Asian session, at GMT0300, the pair is trading at 0.6991, with the AUD trading slightly lower against the USD from yesterday’s close.

Overnight data showed that Australia’s seasonally adjusted trade surplus widened to A$5745.0 million in May, marking a record high level amid surge in iron ore exports to China. In the preceding month the nation had recorded a revised surplus of A$4820.0 million, while market had anticipated to register a surplus of A$5250.0 million.

On the other hand, the nation’s seasonally adjusted building approvals plunged 19.6% on a yearly basis in May, compared to a fall of 24.2% in the previous month. Market participants had envisaged the building approvals to record a decline of 21.5%. Moreover, the AIG performance of services index dropped to a level of 52.2 in June, following a level of 52.5 in the prior month. Also, the CBA final services PMI fell to a level of 52.5 in June, compared to a level of 53.1 in the prior month.

The pair is expected to find support at 0.6967, and a fall through could take it to the next support level of 0.6942. The pair is expected to find its first resistance at 0.7008, and a rise through could take it to the next resistance level of 0.7024.

The currency pair is showing convergence with its 20 Hr moving average and trading above its 50 Hr moving average.