For the 24 hours to 23:00 GMT, the AUD rose 0.29% against the USD and closed at 0.7007.

LME Copper prices rose 0.3% or $17.5/MT to $6,507.0/MT. Aluminium prices climbed 0.7% or $11.0/MT to $1,651.0/MT.

In the Asian session, at GMT0300, the pair is trading at 0.6990, with the AUD trading 0.24% lower against the USD from yesterday’s close.

Overnight data showed that Australia’s consumer inflation expectations rose to 3.2% in July, less than market expectations and compared to 3.3% in the previous month. Additionally, the HIA new home sales surged 87.2% on a monthly basis in May, compared to a drop of 4.2% in the previous month. Meanwhile, the unemployment rate climbed to 7.4% in June, hitting its highest level in 22 years and compared to a rate of 7.1% in the prior month.

Elsewhere in China, Australia’s largest trading partner, gross domestic product surged 11.5% on a quarterly basis in the second quarter of 2020, more than market expectations for a rise of 9.6% and compared to a drop of 9.8% in the previous quarter. Further, the house price index rose 4.9% in June, compared to a similar rise in the previous month. Additionally, industrial production rose 4.8% on a yearly basis in June, more than market forecast for a rise of 4.7% and compared to an advance of 4.4% in the earlier month. Meanwhile, retail sales unexpectedly dropped 1.8% on a yearly basis in June, defying market expectations for a rise of 0.3% and compared to a fall of 2.8% in the earlier month.

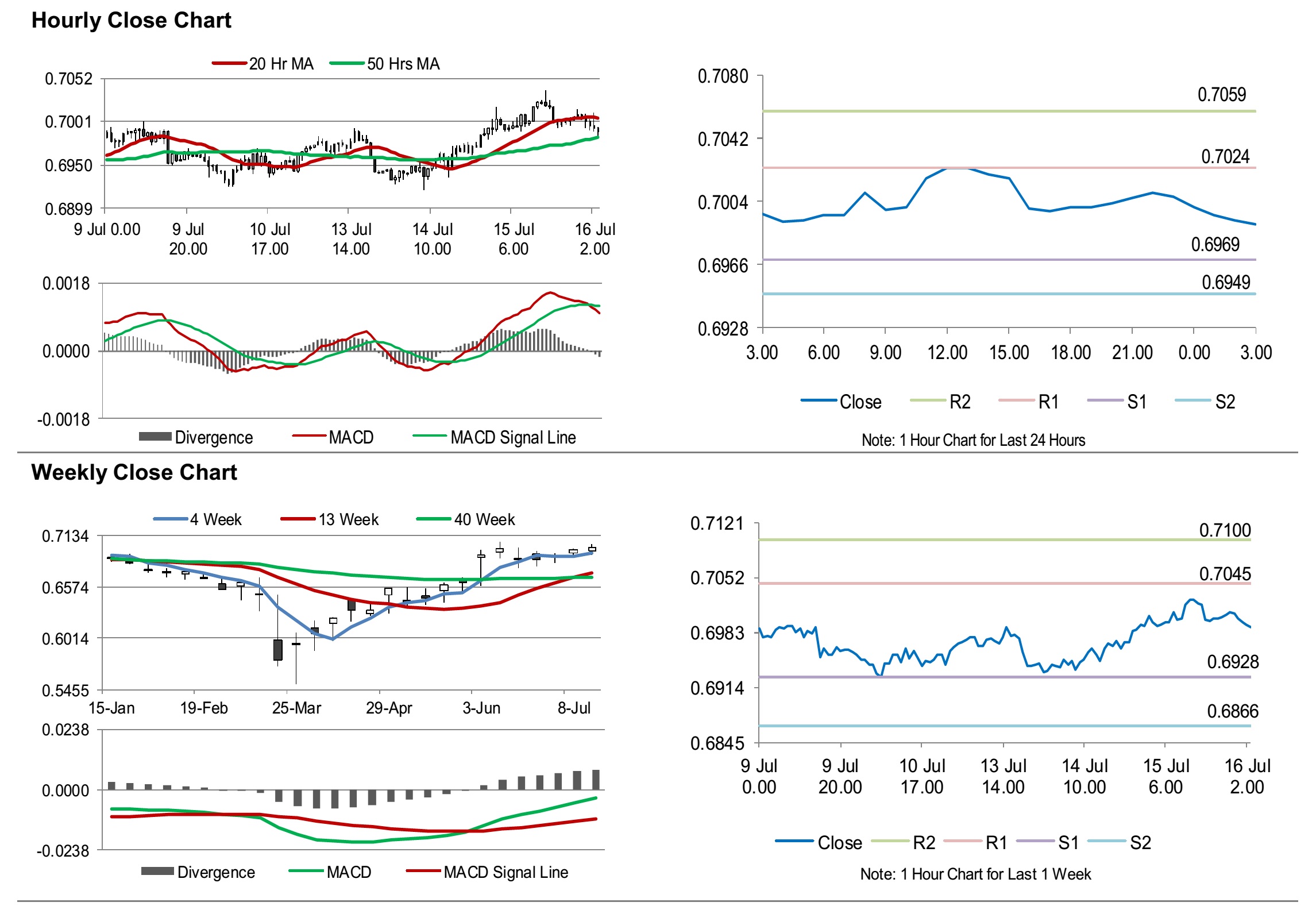

The pair is expected to find support at 0.6969, and a fall through could take it to the next support level of 0.6949. The pair is expected to find its first resistance at 0.7024, and a rise through could take it to the next resistance level of 0.7059.

The currency pair is trading below its 20 Hr moving average and showing convergence with its 50 Hr moving average.