For the 24 hours to 23:00 GMT, the AUD strengthened 0.35% against the USD to close at 0.8787.

LME Copper prices declined 0.02% or $1.0/MT to $6629.0/MT. Aluminium prices rose 3.02% or $56.5/MT to $1929.5/MT.

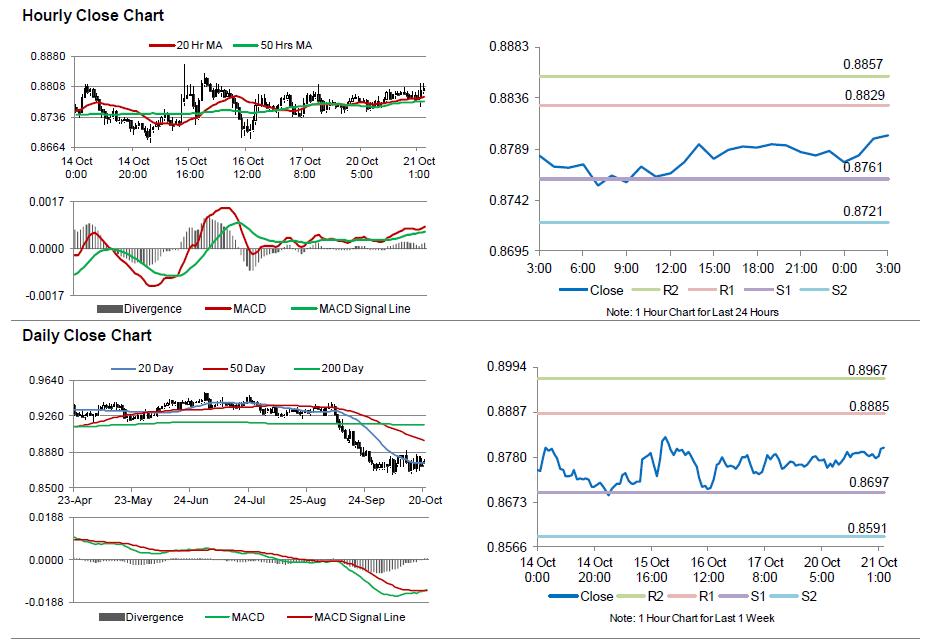

In the Asian session, at GMT0300, the pair is trading at 0.8802, with the AUD trading 0.17% higher from yesterday’s close.

Earlier today, the minutes of the RBA’s October board meeting revealed that the central bank’s policymakers were in no mood to raise the benchmark interest rates and decided to keep it at record low for the foreseeable future as they were concerned over the issuance of riskier loans by lenders due to increased competition.

Elsewhere in China, Australia’s biggest trading partner, GDP expanded 7.3% on an annual basis in Q3 2014, growing at its slowest pace in more than 5-years, down from 7.5% growth registered in the previous quarter, however above market expectations for the GDP to grow 7.3%. Additionally, retail sales registered a rise of 11.6% on an annual basis in September, lower than market expectations for an increase of 11.8% and following 11.9% gain registered in the previous month. Meanwhile, industrial production in China climbed 8.0% on an annual basis in September, exceeding market expectations for a rise of 7.5%. It had risen 6.9% in the preceding month.

The pair is expected to find support at 0.8761, and a fall through could take it to the next support level of 0.8721. The pair is expected to find its first resistance at 0.8829, and a rise through could take it to the next resistance level of 0.8857.

Going forward, market participants await Australia’s CPI data, scheduled overnight.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.