For the 24 hours to 23:00 GMT, the AUD rose 0.12% against the USD and closed at 0.7781.

LME Copper prices declined 0.27% or $18.5/MT to $6811.5/MT. Aluminium prices rose 1.44% or $33.5/MT to $2358.5/MT.

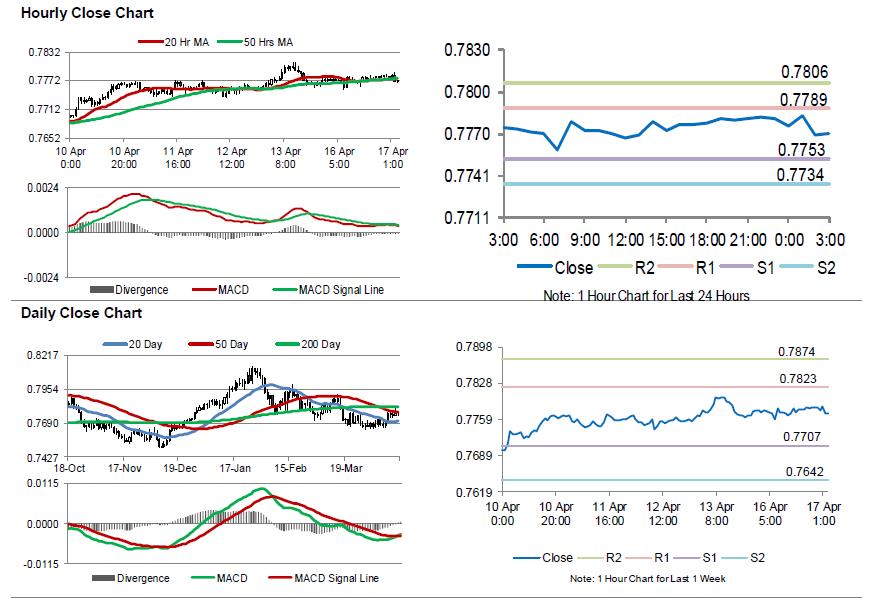

In the Asian session, at GMT0300, the pair is trading at 0.7771, with the AUD trading 0.13% lower against the USD from yesterday’s close.

The minutes of the Reserve Bank of Australia’s (RBA) April monetary policy meeting showed that policymakers are in no rush for a near-term move in monetary policy, as inflation is likely to remain subdued in the face of sluggish wage growth. Nevertheless, the minutes indicated that next move in interest rates was more likely to be up, as officials expect the Australian economic growth to “exceed potential” in the near-term.

Elsewhere in China, Australia’s largest trading partner, gross domestic product (GDP) climbed 6.8% on an annual basis in the first three months of 2018, at par with market expectations, driven by robust consumer spending. In the prior quarter, GDP had registered a similar rise. Moreover, the nation’s retail sales grew more-than-expected by 10.1% YoY in March, compared to an advance of 9.4% in the prior month, while markets were expecting for a gain of 9.7%. Meanwhile, the nation’s industrial production advanced 6.0% on an annual basis in March, undershooting market expectations for a rise of 6.3%. Industrial production had risen 6.2% in the previous month.

The pair is expected to find support at 0.7753, and a fall through could take it to the next support level of 0.7734. The pair is expected to find its first resistance at 0.7789, and a rise through could take it to the next resistance level of 0.7806.

Looking ahead, Australia’s Westpac leading index for March, set to release overnight, will be on investors’ radar.

The currency pair is showing convergence with its 20 Hr and 50 Hr moving averages.