For the 24 hours to 23:00 GMT, the AUD rose 0.08% against the USD and closed at 0.7726.

On the data front, Australia’s CB leading indicator advanced by 0.4% in January, compared to a drop of 0.1% in the preceding month.

LME Copper prices rose 0.03% or $2.0/MT to $5891.0/MT. Aluminium prices rose 0.4% or $7.0/MT to $1908.0/MT.

In the Asian session, at GMT0400, the pair is trading at 0.7709, with the AUD trading 0.22% lower against the USD from yesterday’s close.

According to minutes of the Reserve Bank of Australia’s (RBA) March meeting, board members expect to see Australian consumer prices continue to rise, albeit at a gradual pace. Further, the central bank warned of risks from rapidly climbing nation’s house prices and an acceleration of domestic household debt.

In other economic news, Australia’s house price index advanced 4.1% on a quarterly basis in 4Q 2016, more than market expectations for a rise of 2.5%. The index had climbed 1.5% in the previous quarter.

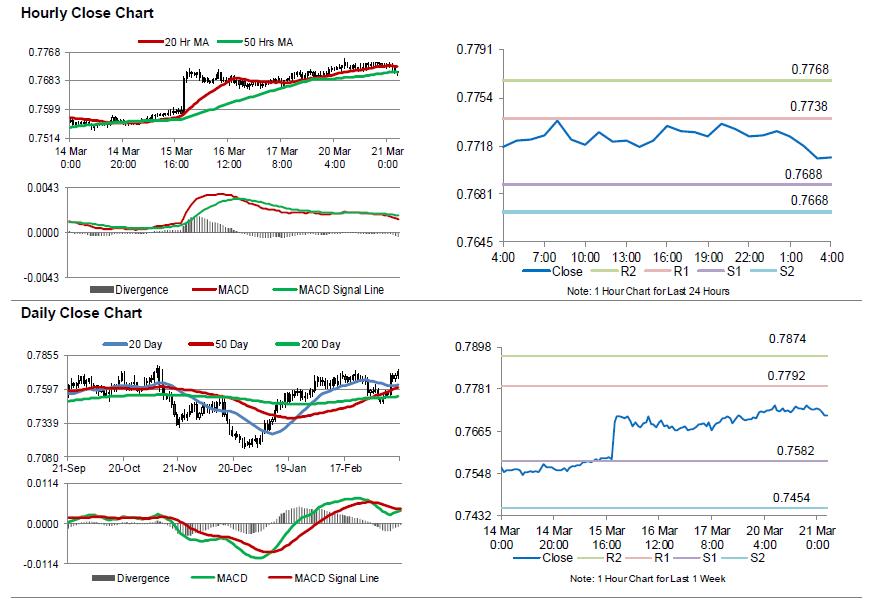

The pair is expected to find support at 0.7688, and a fall through could take it to the next support level of 0.7668. The pair is expected to find its first resistance at 0.7738, and a rise through could take it to the next resistance level of 0.7768.

Going ahead, Australia’s Westpac leading index for February, set to release overnight, will be on investor’s radar.

The currency pair is trading below its 20 Hr moving average and showing convergence with its 50 Hr moving average.