For the 24 hours to 23:00 GMT, the AUD rose 0.26% against the USD and closed at 0.6991.

LME Copper prices remained unchanged at $6180.0/MT. Aluminium prices remained steady at $1783.5/MT.

In the Asian session, at GMT0300, the pair is trading at 0.6999, with the AUD trading 0.11% higher against the USD from yesterday’s close.

Overnight data showed that Australia’s seasonally adjusted trade surplus narrowed to AUD4,949.0 million in March, compared to a revised surplus of AUD5,140.0 million in the previous month. Market participants had anticipated the nation to post a surplus of AUD4,480.00 million. Moreover, the nation’s seasonally adjusted retail sales climbed 0.3% on a monthly basis in March, following a revised rise of 0.9% in the prior month. Market participants had expected retail sales to record a gain of 0.2%.

On the contrary, the nation’s AIG performance of construction index contracted to a level of 42.6, following a reading of 45.6 in the previous month.

The Reserve Bank of Australia (RBA), in its latest policy meeting, opted to leave its benchmark interest rate unchanged at 1.5%, with prospects for further rate reduction in June. The RBA Governor Philip Lowe stated that they would closely monitor the labour market to observe a rise in unemployment in order to slash the interest rates in the forthcoming policy meetings.

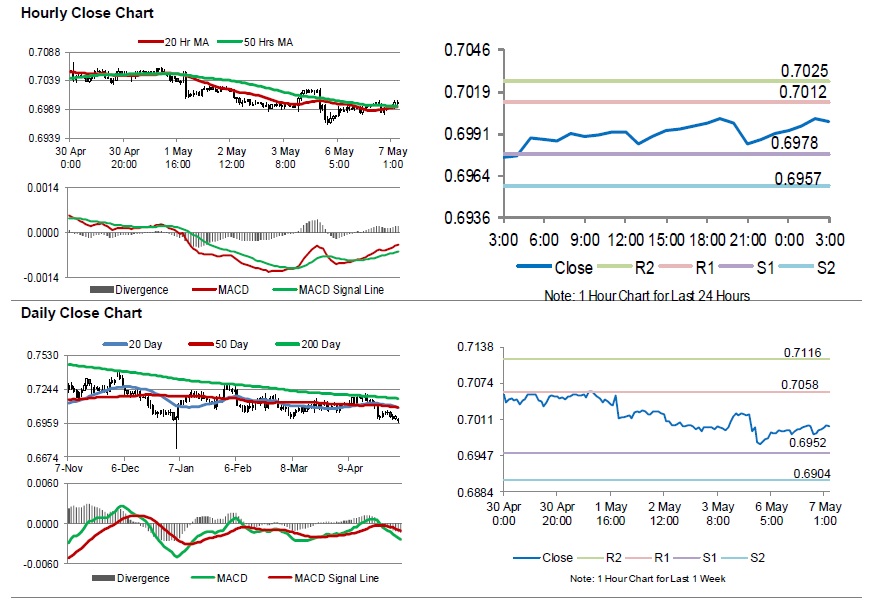

The pair is expected to find support at 0.6978, and a fall through could take it to the next support level of 0.6957. The pair is expected to find its first resistance at 0.7012, and a rise through could take it to the next resistance level of 0.7025.

Amid lack of macroeconomic releases in Australia today, investors would focus on global macroeconomic releases for further direction.

The currency pair is showing convergence with its 20 Hr and 50 Hr moving averages.