For the 24 hours to 23:00 GMT, the AUD rose 0.67% against the USD and closed at 0.7526.

Over the weekend, data revealed that Australia’s AIG performance of manufacturing index advanced to a level of 59.2 in April, compared to a reading of 57.5 in the previous month.

Separately, in China, Australia’s largest trading partner, the NBS manufacturing PMI eased to a level of 51.2 in April, compared to a level of 51.8 in the previous month. Moreover, the nation’s NBS non-manufacturing PMI declined to a level of 54.0 in April, compared to a level of 55.1 in the prior month.

LME Copper prices rose 0.04% or $2.0/MT to $5688.5/MT. Aluminium prices declined 1.3% or $24.5/MT to $1930.0/MT.

Earlier in the session, the Reserve Bank of Australia (RBA), at its latest monetary policy meeting, opted to leave the official cash rate on hold at its historic low of 1.50%, as widely expected. The RBA Governor, Philip Lowe repeated Australia’s housing market concerns, stating that housing prices continue to vary considerably around the country.

Elsewhere, China’s Caixin/Markit manufacturing PMI index registered an unexpected drop to a level of 50.3 in April, confounding market expectations of a rise to a level of 51.3. The PMI had recorded a level of 51.2 in the previous month.

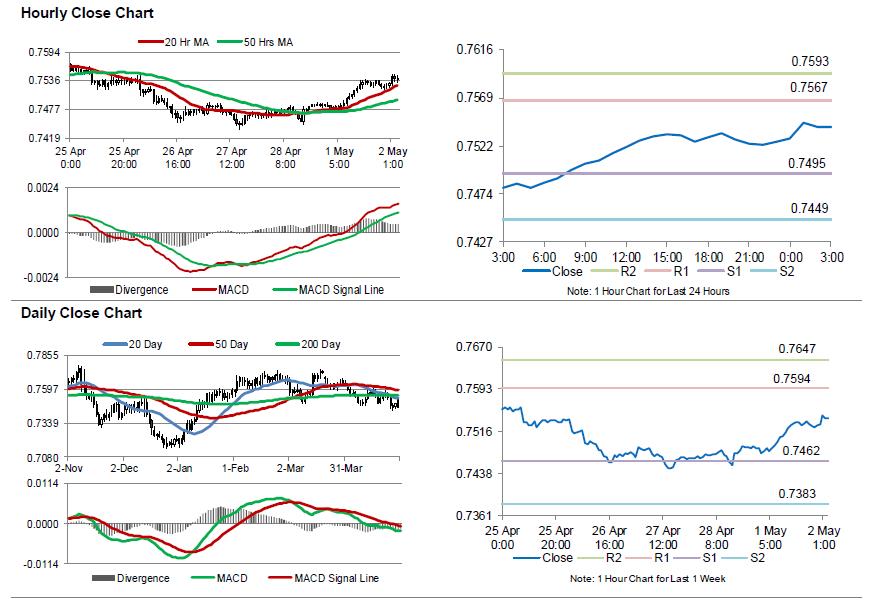

In the Asian session, at GMT0300, the pair is trading at 0.7540, with the AUD trading 0.19% higher against the USD from yesterday’s close.

The pair is expected to find support at 0.7495, and a fall through could take it to the next support level of 0.7449. The pair is expected to find its first resistance at 0.7567, and a rise through could take it to the next resistance level of 0.7593.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.