For the 24 hours to 23:00 GMT, the AUD marginally declined against the USD and closed at 0.7356.

LME Copper prices rose 1.1% or $69.0/MT to $6307.0/MT. Aluminium prices rose 2.5% or $47.5/MT to $1982.5/MT.

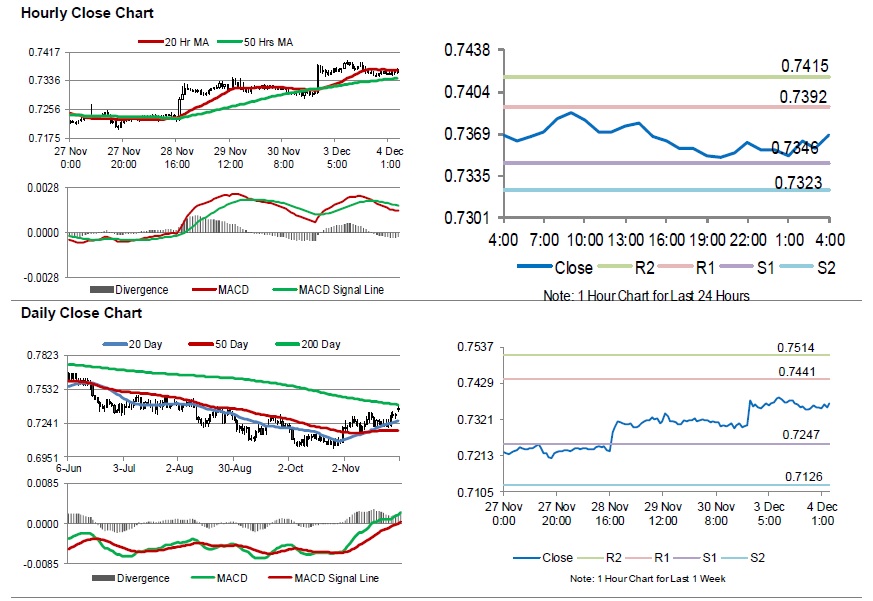

In the Asian session, at GMT0400, the pair is trading at 0.7368, with the AUD trading 0.16% higher against the USD from yesterday’s close.

The Reserve Bank of Australia (RBA), in its latest monetary policy meeting, opted to leave its benchmark interest rate unchanged at its record low rate of 1.50%, amid slowdown in the household growth. The benchmark interest rate has remained stable since August 2016, extending the longest rate of cash-rate stability on record. Further, policymakers expect inflation to rise gradually, increasing to 2.25% in 2019 and further higher in 2020. Meanwhile, the RBA Governor, Philip Lowe, stated that “the low level of interest rates is continuing to support the Australian economy”.

The pair is expected to find support at 0.7346, and a fall through could take it to the next support level of 0.7323. The pair is expected to find its first resistance at 0.7392, and a rise through could take it to the next resistance level of 0.7415.

Moving forward, investors would closely monitor Australia’s AiG performance of service index and the CBA services PMI, both for November, slated to release overnight.

The currency pair is showing convergence with its 20 Hr moving average and trading above its 50 Hr moving average.