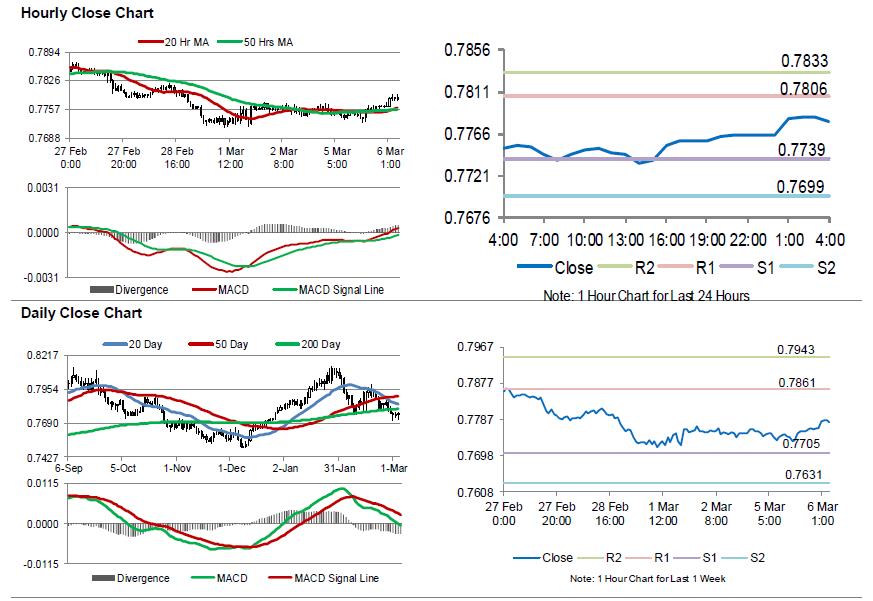

For the 24 hours to 23:00 GMT, the AUD rose 0.26% against the USD and closed at 0.7765.

LME Copper prices declined 0.5% or $33.0/MT to $6850.0/MT. Aluminium prices declined 0.4% or $9.0/MT to $2135.0/MT.

In the Asian session, at GMT0400, the pair is trading at 0.7779, with the AUD trading 0.18% higher against the USD from yesterday’s close.

The RBA, in a widely expected move, decided to keep the official cash rate on hold at 1.50%, on the backdrop of weak wage growth and stubbornly low inflation. In a post-meeting statement, the central bank stated that it now expects the Australian economy to grow faster in 2018 than last year, while inflation is forecasted to remain low for some time.

On the macro front, Australia’s seasonally adjusted retail sales rebounded less-than-expected by 0.1% MoM in January, compared to a drop of 0.5% in the previous month, while markets were expecting retail sales to advance 0.4%.

The pair is expected to find support at 0.7739, and a fall through could take it to the next support level of 0.7699. The pair is expected to find its first resistance at 0.7806, and a rise through could take it to the next resistance level of 0.7833.

Going forward, a speech by the RBA Governor, Philip Lowe, due overnight, would be eyed by traders. Additionally, Australia’s 4Q GDP figures as well as AiG performance of construction index for February, will keep investors on their toes.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.