For the 24 hours to 23:00 GMT, the AUD rose 0.36% against the USD and closed at 0.6975.

LME Copper prices rose 0.3% or $15.5/MT to $5796.0/MT. Aluminium prices rose 0.1% or $2.5/MT to $1763.5/MT.

In the Asian session, at GMT0300, the pair is trading at 0.6972, with the AUD trading marginally lower against the USD from yesterday’s close.

Overnight data showed that Australia’s seasonally adjusted retail sales unexpectedly fell 0.1% on a monthly basis in April, compared to an advance of 0.3% in the previous month. Markets had expected retail sales to record a rise of 0.2%.

The Reserve Bank of Australia (RBA), in its June monetary policy meeting, trimmed its interest rate to 1.25% from 1.50%, for the first time since August 2016, in an effort to support employment growth. However, the central bank indicated that its economy would grow at a rate of 2.75% in 2019 and 2020 and expects inflation to be in the range of 1.75% in 2019 and 2.0% in 2020.

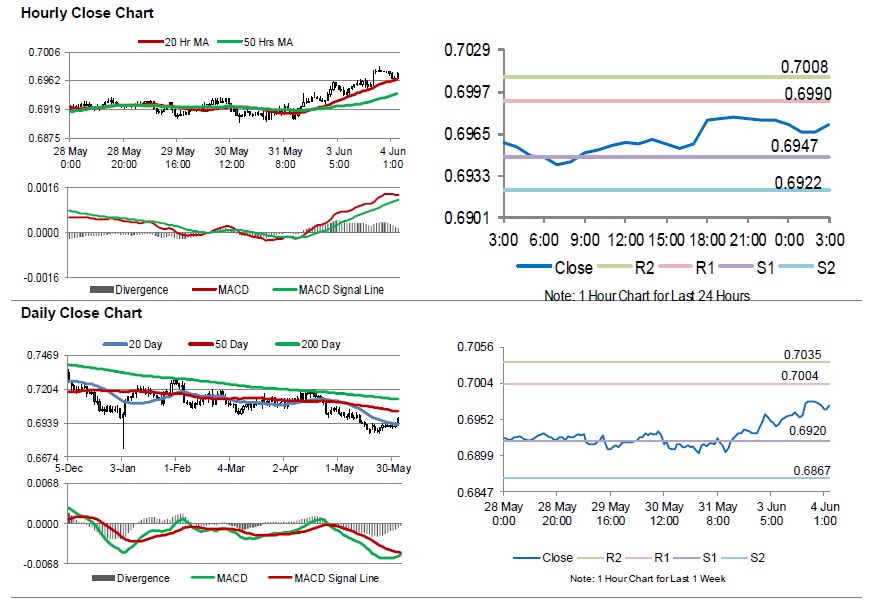

The pair is expected to find support at 0.6947, and a fall through could take it to the next support level of 0.6922. The pair is expected to find its first resistance at 0.6990, and a rise through could take it to the next resistance level of 0.7008.

Moving forward, traders would keep an eye on Australia’s AiG performance of service index and the CBA services PMI, both for May followed by gross domestic product for the first quarter.

The currency pair is showing convergence with its 20 Hr moving average and trading above its 50 Hr moving average.