For the 24 hours to 23:00 GMT, the AUD declined 0.16% against the USD and closed at 0.7602.

LME Copper prices declined 0.6% or $32.0/MT to $5817.0/MT. Aluminium prices rose 0.1% or $2.0/MT to $1948.5/MT.

In the Asian session, at GMT0300, the pair is trading at 0.7603, with the AUD trading a tad higher against the USD from yesterday’s close.

Earlier in the session, the Reserve Bank of Australia (RBA), in its latest monetary policy meeting, held the key interest rate steady at 1.50%, as widely expected.

In economic news, Australia’s seasonally adjusted trade surplus widened more-than-expected to a level of A$3547.0 million in February, boosted by elevated iron ore prices and a sharp fall in imports of consumer goods. Markets anticipated the nation to record a surplus of A$1900.0 million, following a revised surplus of A$1503.0 million in the prior month.

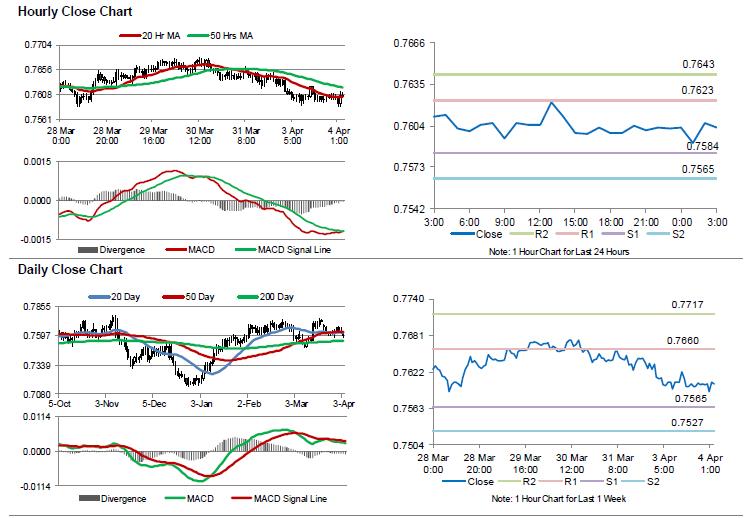

The pair is expected to find support at 0.7584, and a fall through could take it to the next support level of 0.7565. The pair is expected to find its first resistance at 0.7623, and a rise through could take it to the next resistance level of 0.7643.

Looking ahead, investors will direct their attention to Australia’s AiG performance of services index for March, due to release in the early hours’ tomorrow.

The currency pair is showing convergence with its 20 Hr moving average and trading below its 50 Hr moving average.