For the 24 hours to 23:00 GMT, the AUD declined 0.2% against the USD and closed at 0.7947.

LME Copper prices rose 1.4% or $97.0/MT to $6873.0/MT. Aluminium prices declined 0.9% or $18.0/MT to $2095.5/MT.

In the Asian session, at GMT0300, the pair is trading at 0.7965, with the AUD trading 0.23% higher against the USD from yesterday’s close.

Earlier in the session, the Reserve Bank of Australia (RBA), at its latest monetary policy meeting, opted to leave its benchmark interest rate steady at a record low of 1.50%, as widely expected.

Overnight data revealed that Australia’s AiG performance of services index eased to a level of 53.0 in August. The index had recorded a reading of 56.4 in the prior month. Further, the nation’s seasonally adjusted current account deficit widened more-than-anticipated to a level of A$9.6 billion in the second quarter of 2017, following a revised deficit of A$4.8 billion in the prior quarter.

Elsewhere in China, Australia’s largest trading partner, the Caixin services PMI index rose to a level of 52.7 in August, expanding by the most in three months and following a reading of 51.5 in the prior month.

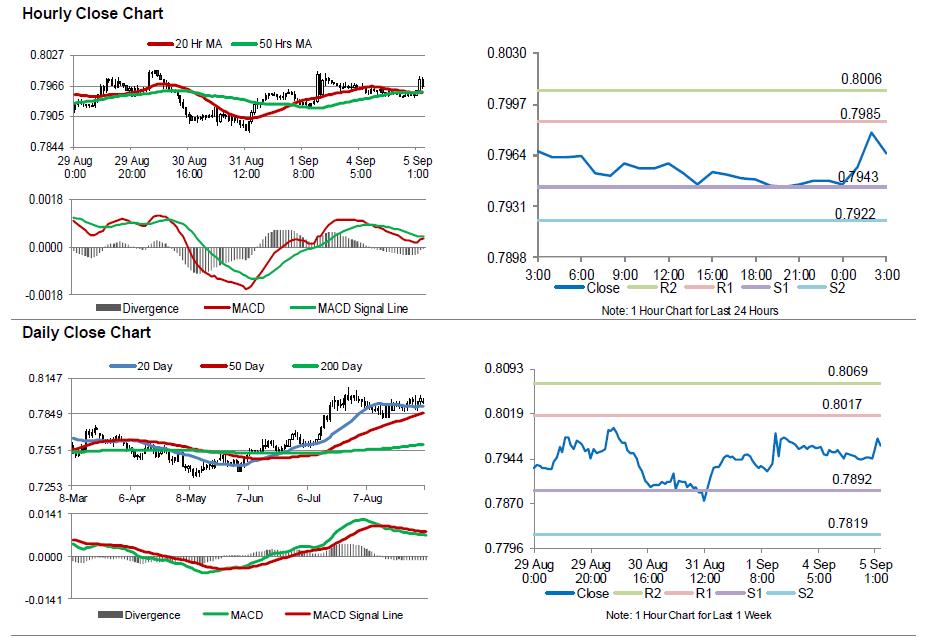

The pair is expected to find support at 0.7943, and a fall through could take it to the next support level of 0.7922. The pair is expected to find its first resistance at 0.7985, and a rise through could take it to the next resistance level of 0.8006.

Looking ahead, traders will closely monitor Australia’s 2Q GDP data, scheduled to release in the early hours of tomorrow.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.