For the 24 hours to 23:00 GMT, the AUD strengthened 0.12% against the USD to close at 0.9409.

Yesterday, data from China, Australia’s biggest trading partner, revealed that CB leading index in China climbed to 100.06 in June, from a revised level of 99.93 in the previous month.

LME Copper prices declined 0.7% or $51.5/MT to $ 7132.0/MT. Aluminium prices declined 1.0% or $21.0/MT to $ 1987.5/MT.

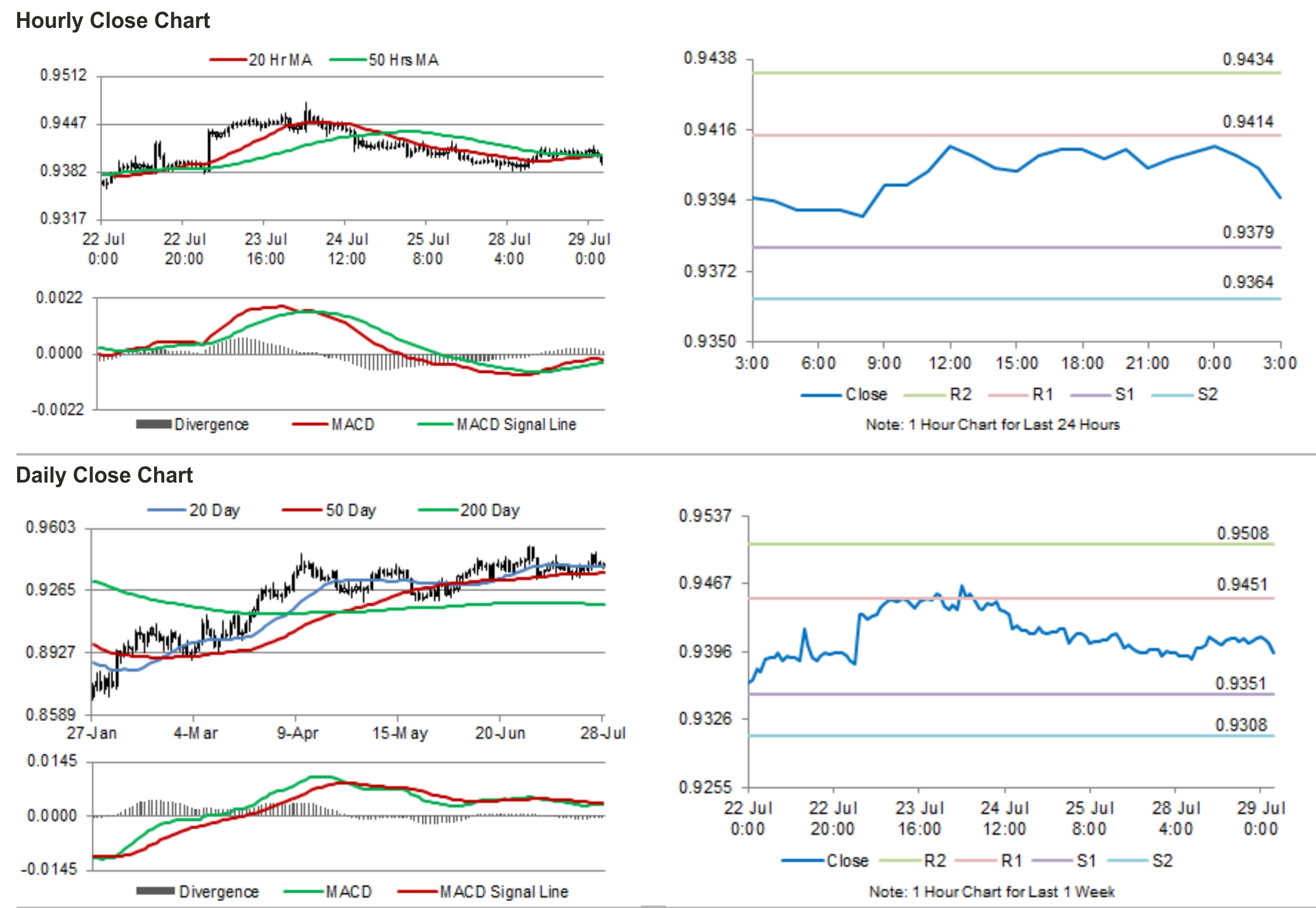

In the Asian session, at GMT0300, the pair is trading at 0.9395, with the AUD trading 0.15% lower from yesterday’s close, after leading ratings agency, Standard & Poors (S&P) cautioned of rising risks for the Australian housing market due to increasing investor participation, subdued income growth and downbeat employment prospects, which could in turn create mortgage repayment pressures for recent, highly leveraged, buyers. However, it further added that the nation’s banking system is strong enough to withstand any shocks from increase in mortgage defaults. The ratings affirmed ratings on Australia at ‘AAA/A-1+’, with outlook stable.

In economic news, the Housing Industry Association reported that the new home sales in Australia climbed 1.2% in June, compared to a decline of 4.3% in the previous month, on a monthly basis.

The pair is expected to find support at 0.9379, and a fall through could take it to the next support level of 0.9364. The pair is expected to find its first resistance at 0.9414, and a rise through could take it to the next resistance level of 0.9434.

Amid lack of economic releases from Australia today, trading trends in the AUD would be determined by external factors.

The currency pair is showing convergence with its 20 Hr and 50 Hr moving averages.