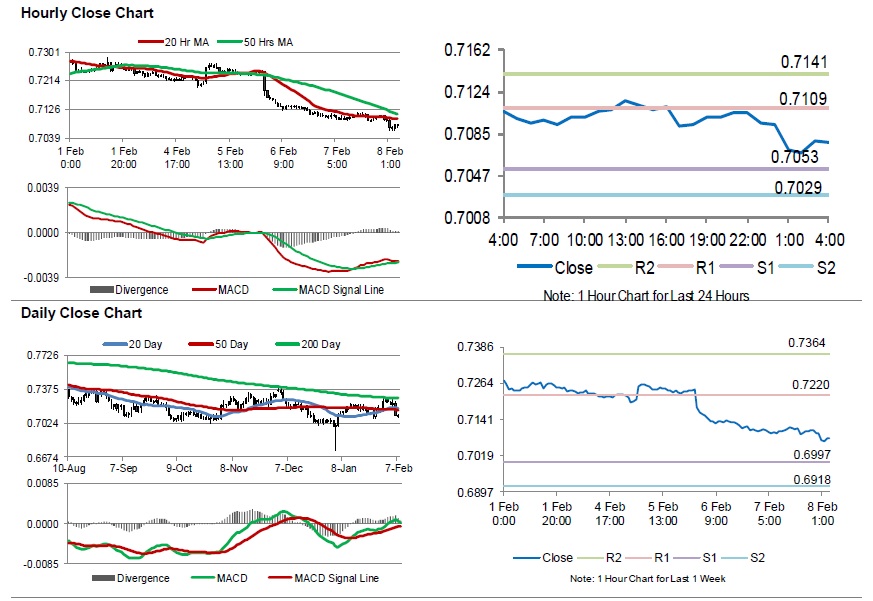

For the 24 hours to 23:00 GMT, the AUD declined 0.20% against the USD and closed at 0.7095.

LME Copper prices rose 0.3% or $17.0/MT to $6227.0/MT. Aluminium prices declined 1.3% or $24.0/MT to $1862.5/MT.

In the Asian session, at GMT0400, the pair is trading at 0.7077, with the AUD trading 0.25% lower against the USD from yesterday’s close.

The Reserve Bank of Australia, in its monetary policy statement, cut its economic and inflation growth forecasts. Accordingly, the central bank now expects economic growth of 2.50% in the 12 months ended 30 June, down from its previous forecast of 3.25%. Additionally, the bank cut its inflation forecast for the same period from 2.00% to 1.25%. Further, the board stated that it does not see strong case to move rates in the near term.

The pair is expected to find support at 0.7053, and a fall through could take it to the next support level of 0.7029. The pair is expected to find its first resistance at 0.7109, and a rise through could take it to the next resistance level of 0.7141.

Going ahead, traders would keep an eye on Australia’s NAB business confidence and Westpac consumer confidence index, both set to release next week.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.