For the 24 hours to 23:00 GMT, the EUR declined 0.41% against the USD and closed at 1.0608.

In economic news, German ZEW economic sentiment index rose less-than-expected to a level of 12.8 in March, suggesting that political uncertainty across the common currency region weighed on the outlook for the Euro-zone’s largest economy. Market expected the index to rise to a level of 13.0, following a level of 10.4 in the prior month. Further, the nation’s ZEW current situation index rose less-than-anticipated to a level of 77.3 in March, following a level of 76.4 registered in the previous month. Meanwhile, the nation’s final consumer price index (CPI) advanced 2.2% on an annual basis in February, at par with market expectations and confirming the preliminary estimates. In the previous month, the CPI had climbed 1.9%.

Separately, the Euro-zone’s ZEW economic sentiment index jumped to a level of 25.6 in March, after recording a level of 17.1 in the prior month. Additionally, the region’s seasonally adjusted industrial production climbed 0.9% on a monthly basis in January, less than market expectations for an advance of 1.3%. In the prior month, industrial production had fallen by a revised 1.2%.

In the US, the NFIB small business optimism index surprisingly dropped to a level of 105.3 in February, compared to a reading of 105.9 in the prior month, while market participants were anticipating the index to register a level of 106.0. On the other hand, the nation’s producer price index rose 0.3% on a monthly basis in February, surpassing market consensus for an advance of 0.1% and following a gain of 0.6% in the prior month.

In the Asian session, at GMT0400, the pair is trading at 1.0615, with the EUR trading 0.07% higher against the USD from yesterday’s close.

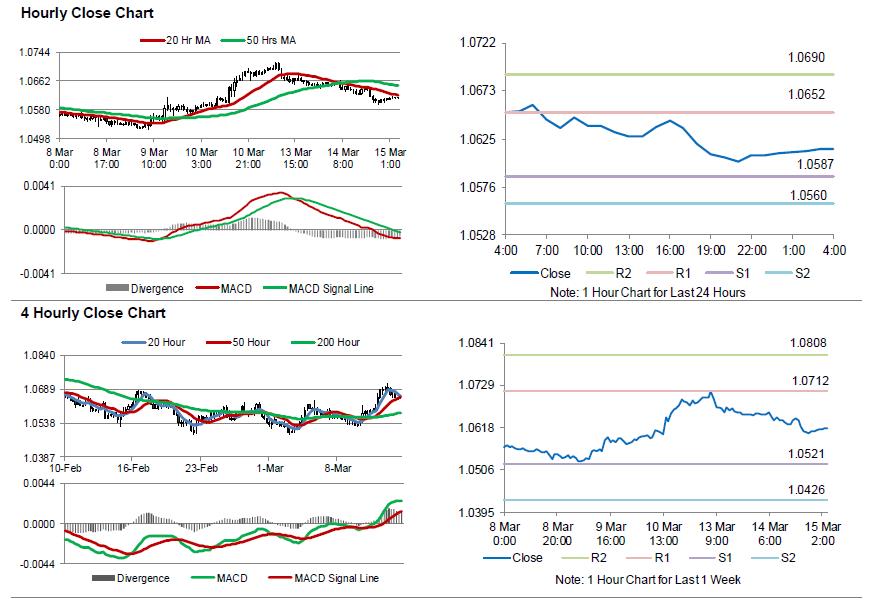

The pair is expected to find support at 1.0587, and a fall through could take it to the next support level of 1.0560. The pair is expected to find its first resistance at 1.0652, and a rise through could take it to the next resistance level of 1.0690.

Today in the Euro-zone, investors look forward to the Dutch elections. Also, all eyes will be on the US Federal Reserve, as it is expected to announce an interest rate hike at its monetary policy meeting later today. Moreover, the US consumer price inflation and advance retail sales, both for February along with the NAHB housing market index for March, will garner a significant amount of market attention.

The currency pair is showing convergence with its 20 Hr moving average and trading below its 50 Hr moving average.