For the 24 hours to 23:00 GMT, the EUR rose 1.15% against the USD and closed at 1.0730, after Dutch election exit polls suggested that the country’s Prime Minister, Mark Rutte’s Liberals were on course for a resounding victory over anti-Islam and anti-EU Geert Wilders, thus easing concerns of a wave of populism in the currency bloc.

The greenback nursed losses against its key peers, following a less hawkish policy statement by the US Federal Reserve (Fed), since it did not suggest an acceleration in the pace of interest rate hikes as some experts had predicted.

The US Fed, at its latest monetary policy meeting, lifted the key interest rate by a quarter-point to a range of 0.75% to 1.0%, a move prompted by steady economic growth, improving labour market and a recent uptick in inflation. In a post-meeting statement, the Fed Chairwoman, Janet Yellen, did not signal an intent to increase rates more than three times this year and stressed that the central bank remains data-dependent. However, decision-makers see slightly faster pace of interest rate hikes in 2019, while projections for 2018 and the longer-run remain unchanged. Meanwhile, officials maintained the US economic growth forecast at 2.1% for 2017, but slightly raised the projection to 2.1% from 2.0% for 2018.

Ahead of the rate announcement, investors had been met by a raft of economic releases. The US consumer price index (CPI) recorded an unexpected rise of 0.1% on a monthly basis in February, confounding market expectations for a flat reading. In the prior month, the CPI had registered a rise of 0.6%. Meanwhile, on an annual basis, the CPI advanced 2.7% in February, in line with market expectations and following a gain of 2.5% in the prior month. Moreover, the nation’s advance retail sales rose 0.1% on a monthly basis in February, recording its smallest increase in six months. Advance retail sales had registered a revised rise of 0.6% in the prior month. Also, the nation’s NAHB housing market index surprisingly jumped to a level of 71.0 in March, surging to its highest level in almost twelve years, amid actions on regulatory reforms by the US President. Markets anticipated the index to remain steady at a level of 65.0.

In other economic news, the US business inventories rose 0.3% in January, meeting market expectations and following a rise of 0.4% in the prior month. Further, the nation’s mortgage applications increased 3.1% in the week ended 10 March 2017, after recording a gain of 3.3% in the prior week.

In the Asian session, at GMT0400, the pair is trading at 1.0721, with the EUR trading 0.08% lower against the USD from yesterday’s close.

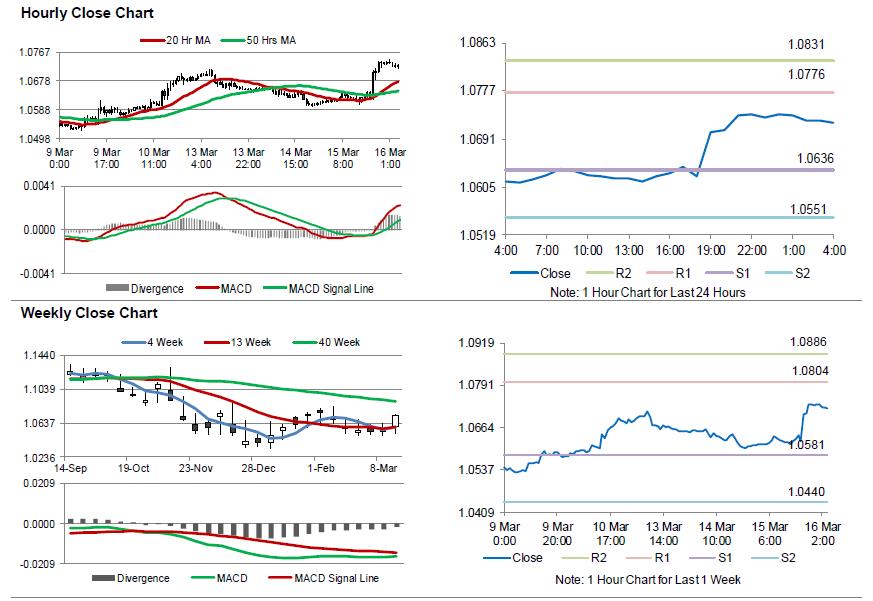

The pair is expected to find support at 1.0636, and a fall through could take it to the next support level of 1.0551. The pair is expected to find its first resistance at 1.0776, and a rise through could take it to the next resistance level of 1.0831.

Going ahead, investors will focus on the Euro-zone’s CPI data for February, scheduled to release in a few hours. In the US, housing starts and building permits, both for February, coupled with initial jobless claims data, will keep investors on their toes. Market participants will also have their eyes on the Trump administration’s fiscal 2018 federal budget plan, due later today.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.