For the 24 hours to 23:00 GMT, the EUR rose 0.13% against the USD and closed at 1.1024, after the European Central Bank (ECB), in a widely expected move, left its key interest rate unchanged at a record low of 0.00% and its asset purchase programme unchanged at €80 billion, in its first policy meeting after Brexit, but left the door open for further easing later this year, once the policymakers are in a better position to assess the exact economic impact from the UK’s vote to leave the European Union. In a press conference accompanied with the meeting, the ECB President, Mario Draghi, pointed that the Euro economy faces heightened downward risk triggered by the Brexit vote and too-slow inflation and also reiterated that the bank will do everything in its power if the Brexit effect starts to weigh on the Euro-zone.

In the US, the number of Americans applying for fresh jobless benefits unexpectedly eased to a three-month low level of 253.0K in the week ended 16 July 2016, indicating that the nation’s labour market regained momentum. Markets expected it to rise to a level of 265.0K, compared to a level of 254.0K in the preceding month. Additionally, the nation’s existing home sales surprisingly rose by 1.1% on a monthly basis in June, rising at the strongest pace in nearly a decade, lifted by low mortgage rates and an improving economy. Existing home sales had registered a revised gain of 1.5% in the previous month while markets expected it to fall by 0.9%. Also, the house price index advanced less-than-expected by 0.2% MoM in May, after recording a revised gain of 0.3% in the prior month. Moreover, the CB leading indicator rebounded by 0.3% in June, beating market consensus for an advance of 0.2% and after recording a fall of 0.2% in the prior month. On the other hand, the nation’s Philadelphia Fed manufacturing index dropped to -2.9 in July, compared to market expectations of a drop to a level of 4.5 and following a level of 4.7 in the prior month.

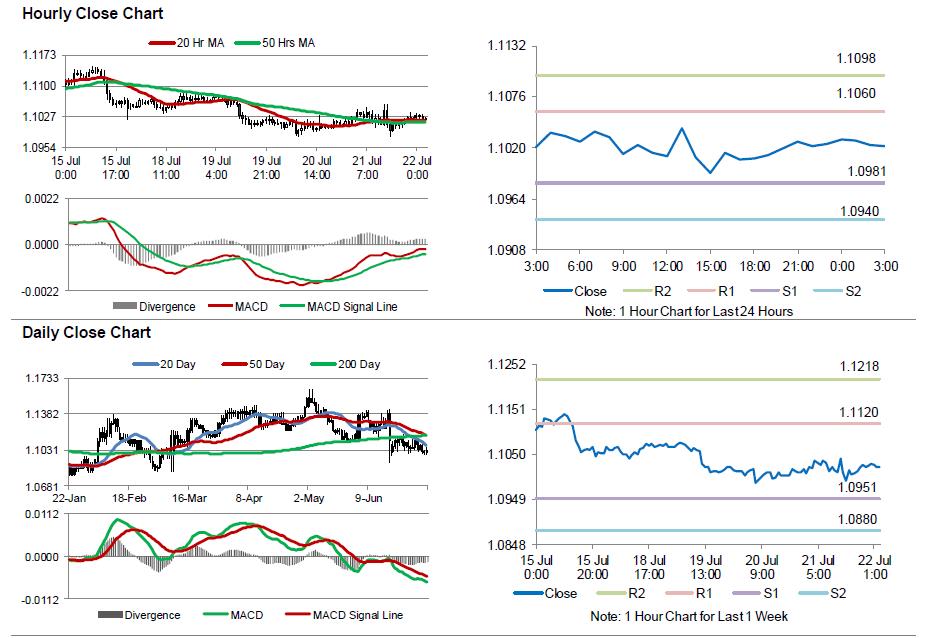

In the Asian session, at GMT0300, the pair is trading at 1.1021, with the EUR trading marginally lower against the USD from yesterday’s close.

The pair is expected to find support at 1.0981, and a fall through could take it to the next support level of 1.094. The pair is expected to find its first resistance at 1.106, and a rise through could take it to the next resistance level of 1.1098.

Market participants would now focus on preliminary Markit manufacturing and services PMI data for July across the Euro-zone, slated to release in a few hours. Additionally, the US flash Markit manufacturing PMI data for July, due later in the day, will also garner a lot of market attention.

The currency pair is showing convergence with its 20 Hr and 50 Hr moving averages.