For the 24 hours to 23:00 GMT, the EUR declined 0.47% against the USD and closed at 1.1767, after the European Central Bank (ECB) boosted the Euro-zone’s 2018 economic growth and inflation forecasts, but stuck with its pledge to maintain its ultra-loose monetary policy as long as needed.

The ECB, as widely expected, maintained the key interest rate unchanged at 0.00% at its recent monetary policy meeting, and signalled that it would keep its aggressive monetary stimulus in place despite strong economic recovery in the Euro-bloc, in order to “sustain inflation” towards the ECB’s target. Further, the central bank boosted the Euro-zone’s growth forecast to 2.4% for 2017, up 0.2% and to 2.3% for 2018, from 1.8% predicted earlier. Inflation is expected to rise 1.4% next year, revised up from 1.2% estimated in September.

Macroeconomic data revealed that the flash Markit manufacturing PMI in the common currency region unexpectedly climbed to a record high level of 60.6 in December, confounding market expectations for a drop to a level of 59.7, thus highlighting that an upturn in the manufacturing sector continued to surge forward. The PMI had recorded a reading of 60.1 in the prior month. Moreover, the region’s preliminary Markit services PMI unexpectedly rose to a level of 56.5 in December, notching its highest level in 80 months. Markets were expecting the PMI to ease to a level of 56.0, after recording a reading of 56.2 in the prior month.

Separately, growth in Germany’s manufacturing sector surprisingly advanced to an all-time high level of 63.3 in December, against market expectations for a fall to a level of 62.0. In the prior month, the PMI had registered a reading of 62.5. Furthermore, the nation’s services sector expanded at its fastest pace in 24 months, after it jumped to a level of 55.8 in December, beating market expectations for an advance to a level of 54.6. The PMI had registered a level of 54.3 in the prior month.

The greenback declined against its major peers, as upbeat US manufacturing sector data was offset by poor report on the services sector.

The flash Markit services PMI in the US registered an unexpected drop to a level of 52.4 in December, hitting its lowest level in over a year. In the previous month, the PMI had registered a level of 54.5, while investors had envisaged for an increase to a level of 54.7. On the other hand, the nation’s preliminary Markit manufacturing PMI surprised to the upside, jumping to an 11-month high level of 55.0 in December, after recording a level of 53.9 in the prior month and defying market consensus for the index to record a steady reading.

Another set of data revealed that advance retail sales in the US grew 0.8% MoM in November, topping market expectations for a gain of 0.3%. Retail sales had risen by a revised 0.5% in the previous month. Also, the number of American filing for fresh jobless claims unexpectedly eased to a level of 225.0K in the week ended 09 December, declining to its lowest level since mid-October. Market participants had anticipated the initial jobless claims to remain steady at a reading of 236.0K recorded in the prior week.

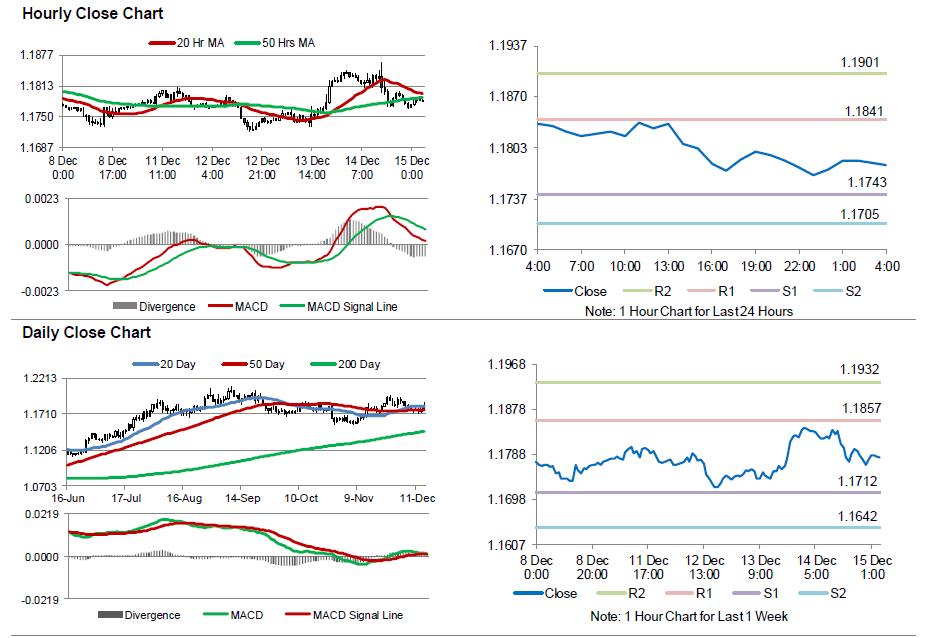

In the Asian session, at GMT0400, the pair is trading at 1.1781, with the EUR trading 0.12% higher against the USD from yesterday’s close.

The pair is expected to find support at 1.1743, and a fall through could take it to the next support level of 1.1705. The pair is expected to find its first resistance at 1.1841, and a rise through could take it to the next resistance level of 1.1901.

Looking ahead, traders would focus on the Euro-zone’s trade balance numbers for October, due to release in a few hours. Additionally, the US industrial and manufacturing production data for November, due to release later in the day, will garner a lot of market attention.

The currency pair is trading below its 20 Hr moving average and showing convergence with its 50 Hr moving average.