For the 24 hours to 23:00 GMT, the EUR declined 0.14% against the USD and closed at 1.2383, after the European Central Bank (ECB) President, Mario Draghi expressed worries over volatility in the Euro.

The ECB, in a widely expected decision, opted to leave the benchmark interest rate unchanged at 0.00% and reiterated its commitment to keep its ultra-easy monetary policy steady for an extended period and well past the end of its bond buying programme, until a self-sustaining rise in inflation is achieved. In a post-meeting statement, the ECB Chief, Mario Draghi, stated that recent economic data confirmed a “robust pace” of economic expansion, adding that inflation will likely rise in the medium term. However, he characterised the recent surge in the Euro as a source of uncertainty for the inflation outlook.

On the economic front, Germany’s Ifo business climate index surprised to the upside, after it advanced to a fresh record high level of 117.6 in January, vindicating that firms remain highly optimistic about their growth prospects despite the lack of a new government four months after a general election. Market participants had envisaged the index to drop to a level of 117.0, after recording a level of 117.2 in the previous month. Moreover, the nation’s Ifo current assessment index unexpectedly advanced to a level of 127.7 in January, defying market anticipation for a drop to a level of 125.3. The index had registered a level of 125.4 in the previous month.

On the other hand, the nation’s Ifo business expectations index declined more-than-estimated to a level of 108.4 in January, after recording a reading of 109.5 in the prior month. Other data indicated that the nation’s GfK consumer confidence index unexpectedly advanced to a level of 11.0 in February, confounding market expectations for the index to remain steady at a level of 10.8.

The greenback gained ground against a basket of major currencies, sparked by comments from the US President, Donald Trump that he favoured a stronger US Dollar and stated that the currency would strengthen along with the US economy.

Macroeconomic data showed that first time claims for the US unemployment benefits climbed less-than-anticipated to a level of 233.0K in the week ended 20 January, compared to a revised reading of 216.0K in the previous week. Investors had expected initial jobless claims to rise to a level of 235.0K. Further, the nation’s new home sales eased 9.3% on monthly basis to a level of 625.0K in December, hitting its lowest level in more than a year. Markets had expected for a drop to a level of 675.0K, compared to a revised reading of 689.0K in the previous month.

On the other hand, the nation’s leading indicator registered a more-than-expected rise of 0.6% in December, compared to a revised gain of 0.5% in the previous month.

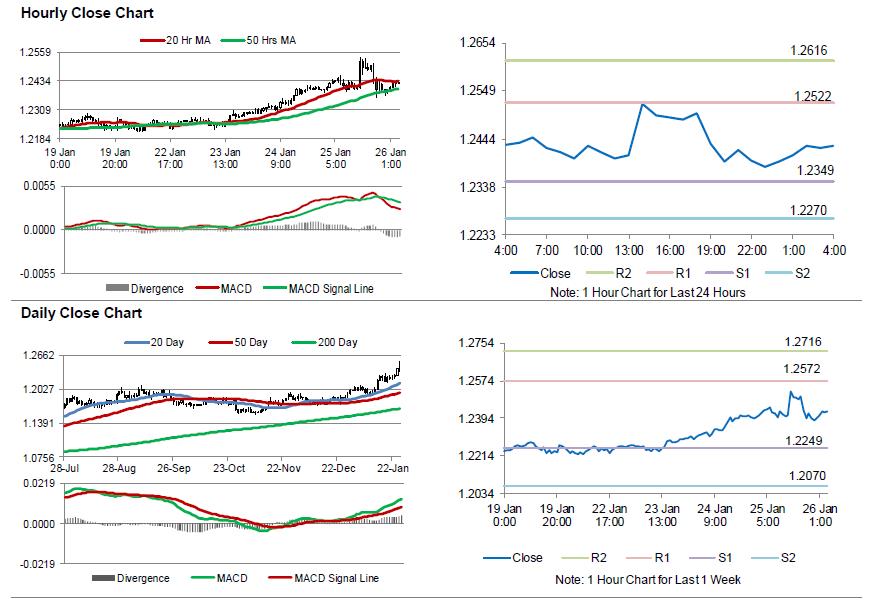

In the Asian session, at GMT0400, the pair is trading at 1.2428, with the EUR trading 0.36% higher against the USD from yesterday’s close.

The pair is expected to find support at 1.2349, and a fall through could take it to the next support level of 1.2270. The pair is expected to find its first resistance at 1.2522, and a rise through could take it to the next resistance level of 1.2616.

With no crucial macroeconomic releases in the Euro-zone today, investors would focus on the US flash 4Q GDP numbers as well as advance goods trade balance and durable goods orders, both for December, scheduled to release later in the day.

The currency pair is showing convergence with its 20 Hr moving average and trading above its 50 Hr moving average.