For the 24 hours to 23:00 GMT, the EUR declined 0.71% against the USD and closed at 1.2315, after the European Central Bank (ECB) Chief, Mario Draghi struck a cautious tone on inflation and signalled that monetary policy would remain accommodative until inflation is solidly back on track towards its 2.0% target.

The ECB, in a widely expected move, maintained the benchmark interest rates unchanged at a record low of 0.00% and continued its asset purchase programme at least until September 2018. In a post-meeting statement, the central bank dropped its pledge to boost its asset purchase programme if the Euro-zone’s economic outlook worsens, thus highlighting its increasingly confidence over the region’s growth outlook. Further, the central bank upgraded its economic growth forecast to 2.4% for this year, from an earlier prediction of 2.3%, while inflation was estimated to remain at 1.4% in 2018.

Separately, Germany’s seasonally adjusted factory orders retreated 3.9% on a monthly basis in January, dropping to its lowest level since January 2017. Factory orders had registered a revised rise of 3.0% in the prior month, while market participants had estimated for a fall of 1.8%.

In the US, data revealed that first time claims for the US unemployment benefits rose to a 6-week high level of 231.0K in the week ended 03 March, after recording a 48-year low level of 210.0K in the prior week. Market participants had envisaged the initial jobless claims to rise to a level of 220.0K.

In the Asian session, at GMT0400, the pair is trading at 1.2310, with the EUR trading slightly lower against the USD from yesterday’s close.

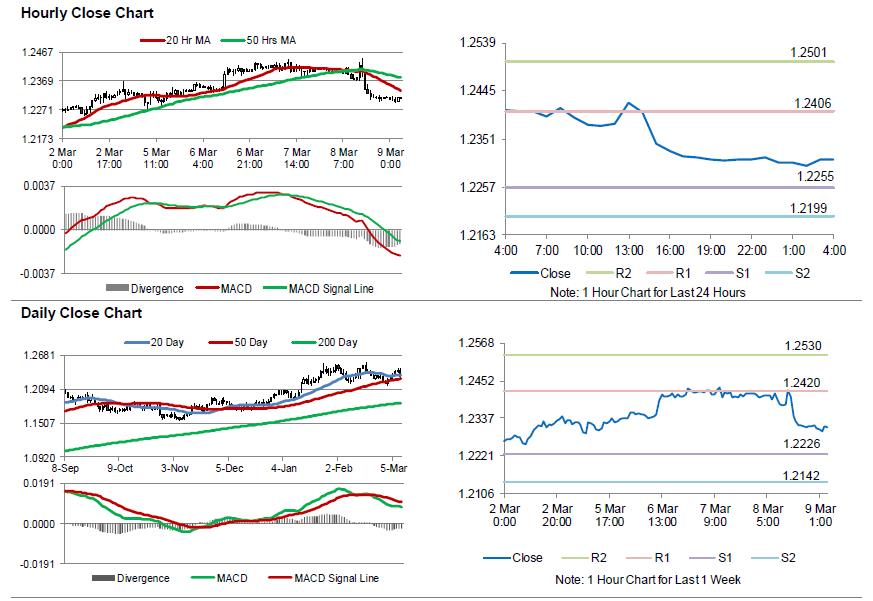

The pair is expected to find support at 1.2255, and a fall through could take it to the next support level of 1.2199. The pair is expected to find its first resistance at 1.2406, and a rise through could take it to the next resistance level of 1.2501.

Going ahead, investors would keep a close watch on Germany’s trade balance and industrial production figures, both for January, slated to release in a few hours. Later today, market participants would focus on the crucial US non-farm payrolls, unemployment rate as well as average hourly earnings data, all for February, to gauge strength in the nation’s labour market.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.