For the 24 hours to 23:00 GMT, the EUR declined 0.53% against the USD and closed at 1.2105, after the European Central Bank (ECB) Chief, Mario Draghi, acknowledged recent softness in the Euro-zone economy.

The ECB, at its April monetary policy meeting, decided to keep the benchmark interest rate steady at 0.00%, amid indications of an apparent slowdown in the Eurozone’s growth momentum. In a statement post-meeting, the ECB President, Mario Draghi, argued that growth in the common currency region remained strong but acknowledged evidence of a “moderation” in the exceptional growth pace seen last year. Further, the Governing Council remained confident that underlying strength in the economy will help inflation converge towards the central bank’s 2.0% target in the near-term.

Separately, data indicated that Germany’s GfK consumer confidence index eased to a level of 10.8 in May, meeting market expectations. The index had registered a level of 10.9 in the previous month.

The US Dollar advanced against a basket of major currencies, following a slew of upbeat economic releases in the US.

Data indicated that advance goods trade deficit in the US narrowed more-than-anticipated to $68.0 billion in March, dropping for the first time in 7 months, amid strong growth in exports. The nation had posted a revised deficit of $75.9 billion in the prior month, while investors had envisaged it to narrow to $75.0 billion. Moreover, the nation’s flash durable goods orders rose 2.6% on a monthly basis in March, topping market expectations for a rise of 1.6%. In the prior month, durable goods orders had advanced by a revised 3.0%.

In other economic news, the US initial jobless claims dropped to a more than 48-year low level of 209.0K in the week ended 21 April, compared to market expectations for a fall to a level of 230.0K. In the previous week, initial jobless claims had recorded a revised reading of 233.0K.

In the Asian session, at GMT0300, the pair is trading at 1.2112, with the EUR trading 0.06% higher against the USD from yesterday’s close.

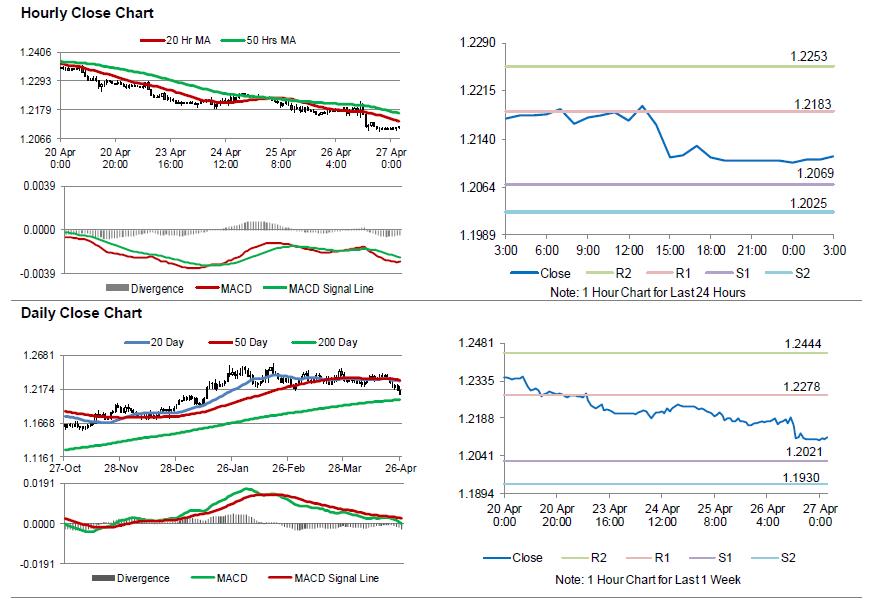

The pair is expected to find support at 1.2069, and a fall through could take it to the next support level of 1.2025. The pair is expected to find its first resistance at 1.2183, and a rise through could take it to the next resistance level of 1.2253.

Going ahead, investors would look forward to the Euro-zone’s final consumer confidence index as well as Germany’s unemployment rate data, both for April, slated to release in a few hours. Also, the US 1Q GDP numbers and the final Michigan consumer sentiment index for April, will garner significant amount of market attention.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.