For the 24 hours to 23:00 GMT, the EUR declined 0.23% against the USD and closed at 1.1341, after the European Commission downgraded its growth forecasts for the euro area.

The European Commission downgraded its growth forecasts for the euro area for 2019 and 2020, citing heightened uncertainty and downside risks to the outlook. It slashed Eurozone’s economic growth projection for this year to 1.3% from 1.9% and to 1.6% from 1.7% for 2020.

Data indicated that Germany’s seasonally adjusted industrial production unexpectedly fell for the fourth consecutive month by 0.4% on a monthly basis in December, confounding market consensus for an advance of 0.8%. In the prior month, industrial production had recorded a revised drop of 1.3%.

In the US, data showed that the US consumer credit rose $16.6 billion in December, less than market expectations for a gain of $17.0 billion. In the prior month, consumer credit had registered a revised increase of $22.4 billion. Moreover, seasonally adjusted initial jobless claims fell to a level of 234.0K in the week ended 02 February 2019, signalling robust labour market strength and less than market expectations for a fall to a level of 221.0K. Initial jobless claims had registered a reading of 253.0K in the previous week.

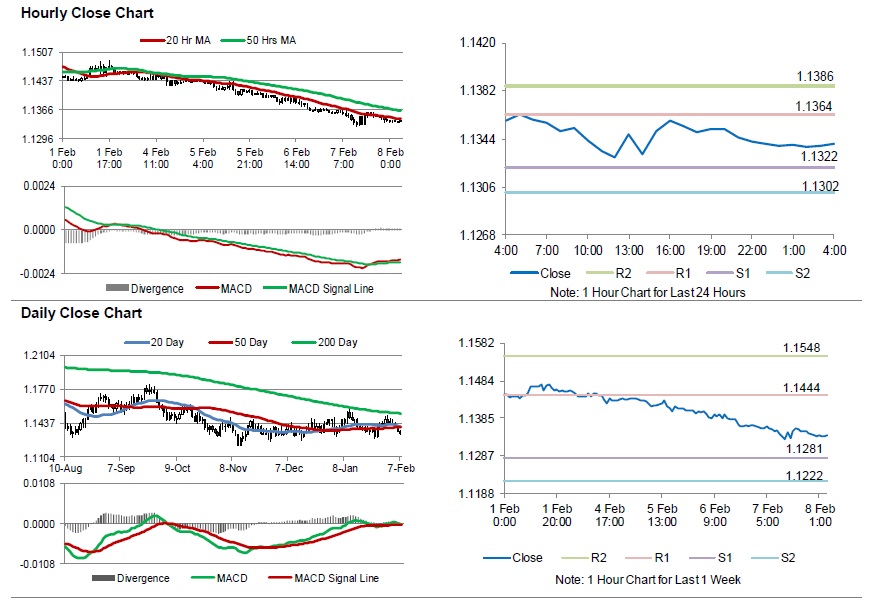

In the Asian session, at GMT0400, the pair is trading at 1.1341, with the EUR trading flat against the USD from yesterday’s close.

The pair is expected to find support at 1.1322, and a fall through could take it to the next support level of 1.1302. The pair is expected to find its first resistance at 1.1364, and a rise through could take it to the next resistance level of 1.1386.

Looking ahead, traders would await Germany’s trade balance data for December, set to release in a while.

The currency pair is showing convergence with its 20 Hr moving average and trading below its 50 Hr moving average.