For the 24 hours to 23:00 GMT, the EUR declined 0.57% against the USD and closed at 1.1367, after the European Commission lowered the country’s growth forecast.

The European Commission, in its Autumn forecast, warned that economic growth in the euro area would decelerate over the next two years. As a result, in the near term, economic growth is expected to continue at about the same pace as in the first half of the year, resulting in a growth of 2.1%. Real GDP was projected to grow 1.9% in 2019, which was slower than the 2.0% forecasted earlier.

Data indicated that Germany’s seasonally adjusted trade surplus widened to €18.4 billion in September, from a trade surplus of €17.2 billion in the previous month. Market participants had envisaged for the nation to post a trade surplus of €20.0 billion.

The US dollar gained ground against a basket of currencies, after the Federal Reserve (Fed) kept its key interest rate unchanged and hinted at further rate hike in December. The Fed, in its latest monetary policy meeting, decided to keep its benchmark interest rate unchanged at 2.25%, as widely expected. The central bank stated that the economy expanded at a strong pace along with robust employment growth. Moreover, the bank reiterated that it expects gradual increase in interest rates, with further interest rate hike in December. However, the Fed cautioned over the slowdown in business investment growth.

Other data showed that the US seasonally adjusted initial jobless claims dropped to a level of 214.0K in the week ended 03 November 2018, in line with expectation and recording its lowest level in 45 years. In the previous week, initial claims had recorded a revised reading of 215.0K.

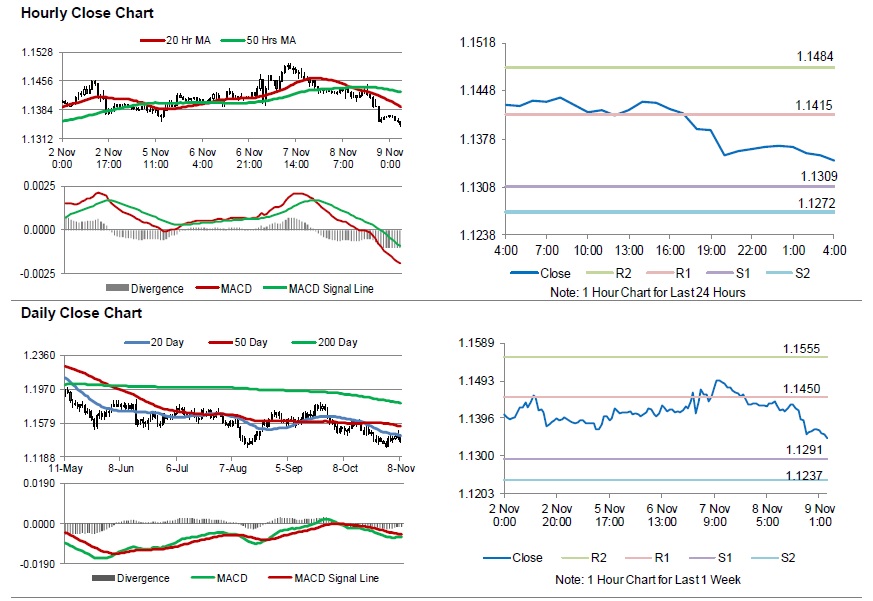

In the Asian session, at GMT0400, the pair is trading at 1.1346, with the EUR trading 0.18% lower against the USD from yesterday’s close.

The pair is expected to find support at 1.1309, and a fall through could take it to the next support level of 1.1272. The pair is expected to find its first resistance at 1.1415, and a rise through could take it to the next resistance level of 1.1484.

Amid lack of economic releases in the Euro-zone today, traders would look forward to the US producer price index for October and the Michigan consumer sentiment index for November, slated to release later in the day.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.