For the 24 hours to 23:00 GMT, the EUR rose 0.55% against the USD and closed at 1.1917.

Yesterday, the European Central Bank (ECB), in its latest economic bulletin report, stated that Euro-zone’s economic growth continues to show “solid and broad-based expansion” and expressed confidence that inflation will converge towards its target over the medium term. However, the central bank acknowledged a moderation in economic growth in the first quarter of this year.

The US Dollar declined against a basket of major currencies, after the US consumer price index (CPI) rose less-than-anticipated by 0.2% on a monthly basis in April, compared to market expectations for a rise of 0.3%, thus highlighting a steady build-up in inflationary pressures that will likely keep the Federal Reserve on track to raise interest rates gradually this year. The CPI had registered a drop of 0.1% in the previous month. Meanwhile, the nation’s initial jobless claims remained unchanged at a level of 211.0K in the week ended 05 May, whereas investors had envisaged for a rise to a level of 219.0K.

In other economic news, budget surplus in the US recorded a reading of $214.3 billion in April, undershooting market consensus for a surplus of $215.0billion. The US had registered a budget deficit of $208.7 billion in the prior month.

In the Asian session, at GMT0300, the pair is trading at 1.1913, with the EUR trading slightly lower against the USD from yesterday’s close.

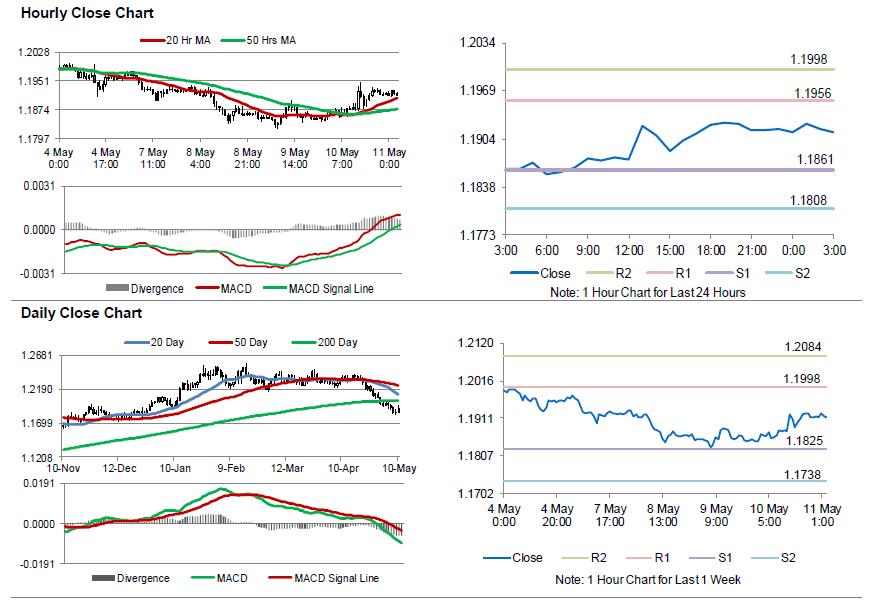

The pair is expected to find support at 1.1861, and a fall through could take it to the next support level of 1.1808. The pair is expected to find its first resistance at 1.1956, and a rise through could take it to the next resistance level of 1.1998.

With no key macroeconomic releases in the Euro-zone today, investors would focus on the US flash Michigan consumer sentiment index for May, slated to release later in the day.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.