For the 24 hours to 23:00 GMT, the EUR rose 0.16% against the USD and closed at 1.1660 on Friday.

On the data front, in France, Euro-zone’s second largest economy, preliminary gross domestic product (GDP) climbed 0.2% on a quarterly basis in the second quarter of 2018, less than market expectations for an advance of 0.3%. In the previous quarter, GDP had registered a similar rise.

The US dollar declined against a basket of currencies, following weaker-than-expected GDP growth.

In the US, data showed that the US flash annualised gross domestic product (GDP) advanced 4.1% on a quarterly basis in Q2 2018, undershooting market expectations for a rise of 4.2%. In the preceding quarter, GDP had risen 2.0%. Meanwhile, the nation’s final Reuters/Michigan consumer sentiment index dropped less than initially estimated to a 6-month low level of 97.9 in July. In the prior month, the index had recorded a reading of 98.2. The preliminary figures had indicated a decline to a level of 97.1.

In the Asian session, at GMT0300, the pair is trading at 1.1651, with the EUR trading 0.08% lower against the USD from Friday’s close.

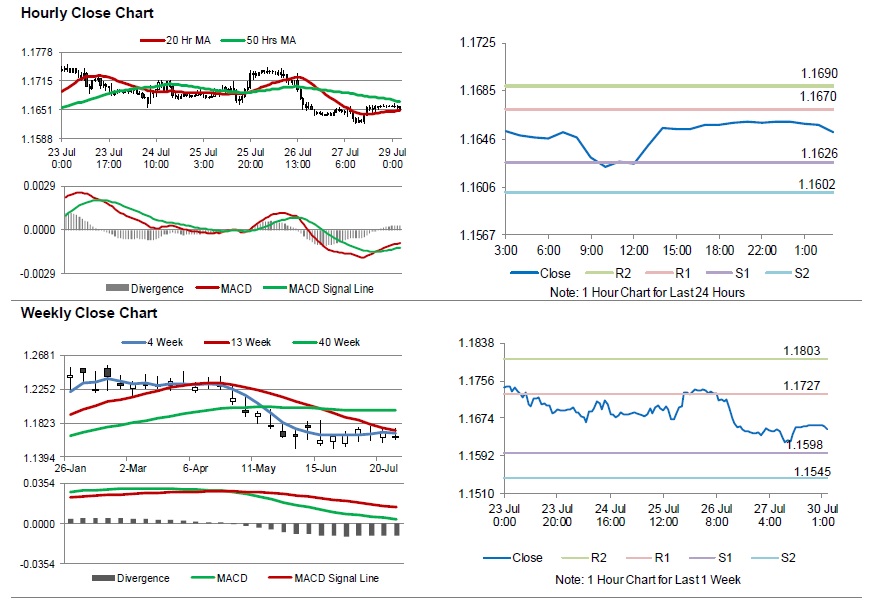

The pair is expected to find support at 1.1626, and a fall through could take it to the next support level of 1.1602. The pair is expected to find its first resistance at 1.1670, and a rise through could take it to the next resistance level of 1.1690.

Moving ahead, investors will await Euro-zone’s consumer confidence index, business climate indicator and economic confidence index, all for July, slated to release in few hours. Later in the day, the US pending home sales data for June and the Dallas Fed manufacturing activity for July, will garner significant amount of investor attention.

The currency pair is showing convergence with its 20 Hr moving average and trading below its 50 Hr moving average.