For the 24 hours to 23:00 GMT, the EUR rose 0.34% against the USD and closed at 1.1609 on Friday.

In economic news, the Euro-zone’s final consumer price index (CPI) climbed by 1.9% on an annual basis in May, in line with market expectation and meeting the preliminary print. In the prior month, the CPI had recorded a revised gain of 13%. Additionally, the region’s seasonally adjusted trade surplus narrowed to a six-month low of €18.1 billion in April, after recording a surplus of €21.2 billion in the previous month. Markets were expecting the region’s trade surplus to narrow to €20.0 billion.

Separately, in Germany, the Bundesbank downgraded the country’s growth forecast for 2018 to 2.0% from 2.5% projected in December. However, the bank raised its forecast to 1.9% and 1.6% for 2019 and 2020, respectively.

In the US, the New York Empire State manufacturing index unexpectedly increased to a level of 25.0 in June, compared to a level of 20.1 in the previous month and confounding market consensus for it to ease to a level of 18.8. Moreover, the nation’s industrial production unexpectedly fell 0.1% MoM in May, confounding market expectations for a rise of 0.2%. In the prior month, industrial production had registered a revised rise of 0.9%. Further, manufacturing production dropped 0.7% on a monthly basis in May, while markets were expecting for a flat reading. In the previous month, manufacturing production had recorded a revised gain of 0.6%. Meanwhile, the preliminary Reuters/Michigan consumer sentiment index climbed to a level of 99.3 in May, exceeding market expectations for a rise to a level of 98.5. In the previous month, the index had recorded a reading of 98.0.

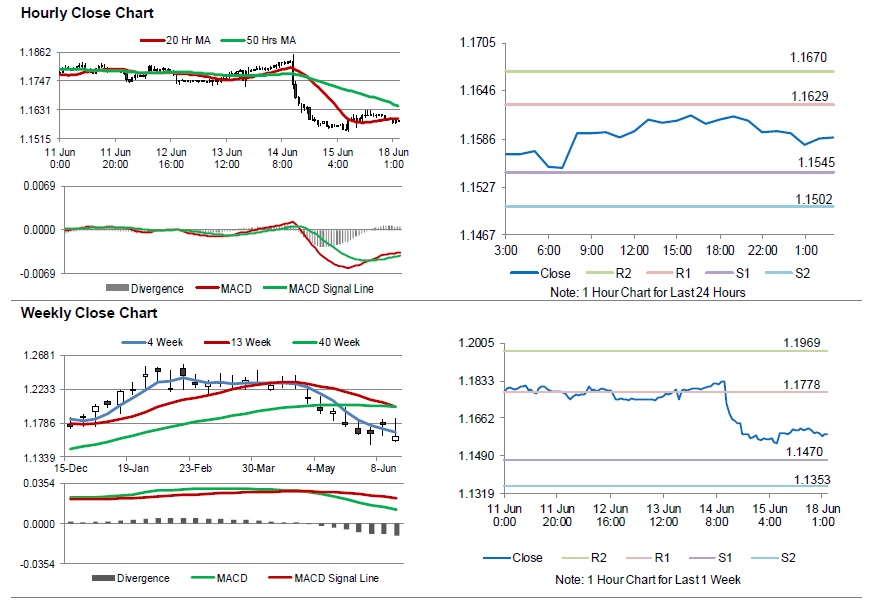

In the Asian session, at GMT0300, the pair is trading at 1.1588, with the EUR trading 0.18% lower against the USD from Friday’s close.

The pair is expected to find support at 1.1545, and a fall through could take it to the next support level of 1.1502. The pair is expected to find its first resistance at 1.1629, and a rise through could take it to the next resistance level of 1.1670.

In absence of crucial macroeconomic releases in the Euro-zone today, investors would keep a close watch on the US NAHB housing market index for June, set to release later in the day.

The currency pair is showing convergence with its 20 Hr moving average and trading below its 50 Hr moving average.