For the 24 hours to 23:00 GMT, the EUR rose 0.09% against the USD and closed at 1.0983 on Friday.

In the US, data showed that the unemployment rate unexpectedly declined to a 50-year low level of 3.5% in September, defying market expectation of a steady reading. In the prior month, unemployment rate stood at 3.7%.

Meanwhile, the nation’s trade deficit widened more-than-expected to $54.9 billion in August, as imports of consumer goods surged to a record high level and compared to a deficit of $54.0 billion in the prior month. Market participants has envisaged the nation to post a deficit of $54.5 billion. Also, the non-farm payrolls increased 136.0K in September, lower than market anticipation for a rise of 145.0K. Non-farm payrolls had recorded a revised gain of 168.0K in the prior month. Moreover, the US average hourly earnings of all employees rose 2.9% on an annual basis in September, less than market consensus for an advance of 3.2%. In the prior month, average hourly earnings of all employees had advanced 3.2%.

The Federal Reserve’s Chairman Jerome Powell reiterated that economic growth continues to remain strong despite some risks and the central bank is prepared to take measures to maintain its momentum.

In the Asian session, at GMT0300, the pair is trading at 1.0985, with the EUR trading a tad higher against the USD from Friday’s close.

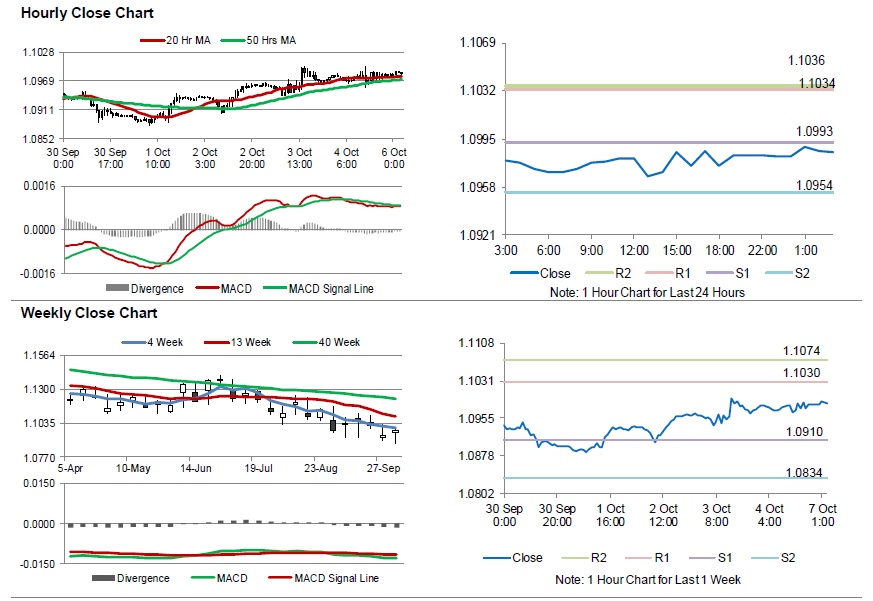

The pair is expected to find support at 1.0993, and a fall through could take it to the next support level of 1.0954. The pair is expected to find its first resistance at 1.1034, and a rise through could take it to the next resistance level of 1.1036.

Going ahead, traders would await Euro-zone’s Sentix investor confidence for October along with Germany’s factory orders for August, set to release in a few hours. Later in the day, the US consumer credit for August will garner significant amount of investor’s attention.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.