For the 24 hours to 23:00 GMT, the EUR declined 0.07% against the USD and closed at 1.1091.

In the US, data showed that existing home sales rose 2.5% to a level of 5.42 million on monthly basis in July. Existing home sales had registered a revised reading of 5.29 million in the previous month. In the US, the MBA mortgage applications fell 0.9% on a weekly basis in the week ended 16 August 2019, compared to a jump of 21.7% in the previous week.

Separately, the Federal Reserve (Fed), in its latest monetary policy meeting, indicated that the central bank intends to remain flexible regarding future interest rate cuts. Regarding the last month’s rate cut, the minutes revealed that some officials preferred a 50 basis point rate cut in July rather than a 25 basis point cut to address the low inflation. The rate cut was described as a “mid-cycle adjustment,” and not a “pre-set future course” for further cuts. Meanwhile, some policymakers expressed concerns over the persistent inversion of 3-month/10-year yield curve.

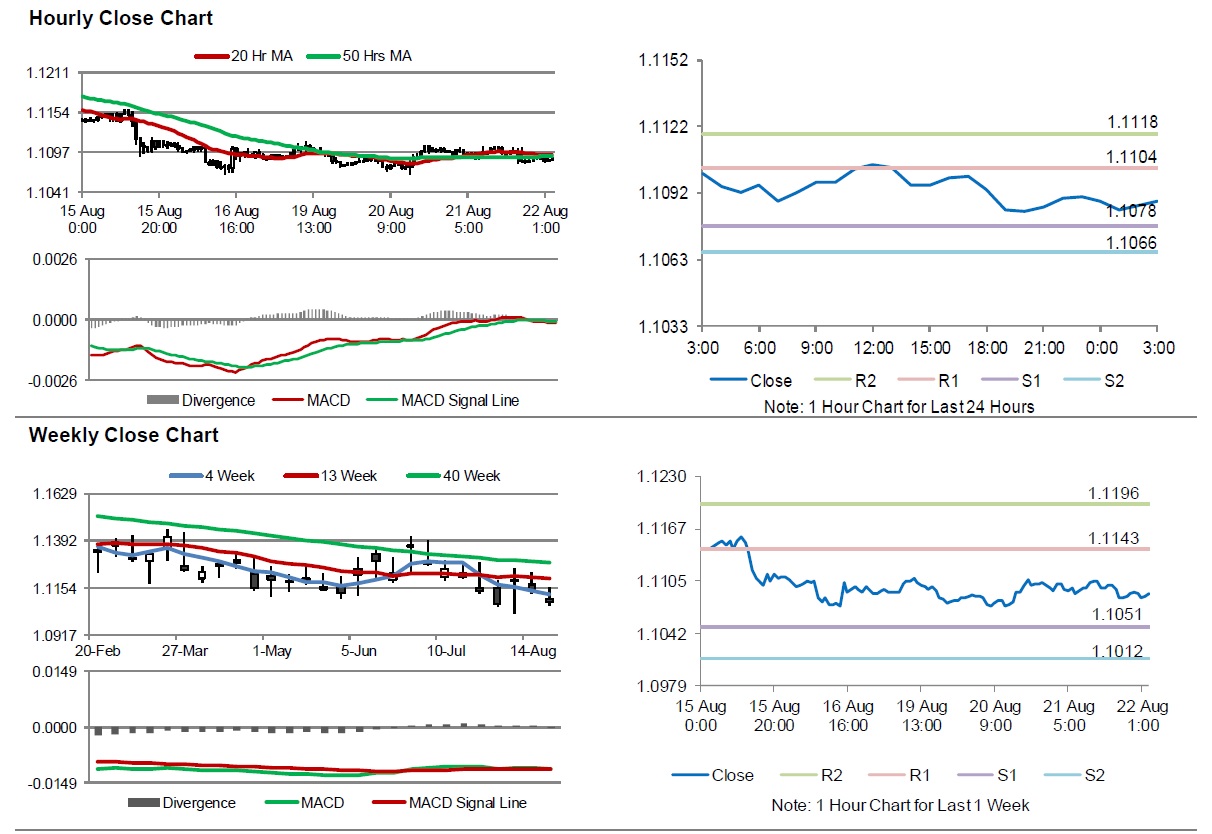

In the Asian session, at GMT0300, the pair is trading at 1.1089, with the EUR trading slightly lower against the USD from yesterday’s close.

The pair is expected to find support at 1.1078, and a fall through could take it to the next support level of 1.1066. The pair is expected to find its first resistance at 1.1104, and a rise through could take it to the next resistance level of 1.1118.

Looking ahead, traders would keep a close watch on the Euro-zone’s consumer confidence index for August along with the manufacturing and services PMIs for August, slated to release across the euro area in a few hours. Moreover, the US initial jobless claims followed by the manufacturing and services PMIs for August as along with the leading index for July, all scheduled to release later in the day, will keep investors on their toes.

The currency pair is showing convergence with its 20 Hr and 50 Hr moving averages.