For the 24 hours to 23:00 GMT, the EUR rose 0.39% against the USD and closed at 1.2382.

The US Dollar declined against its major counterparts, amid renewed geopolitical tensions after the US President, Donald Trump, accused Russia and China of playing the currency devaluation game in order to gain unfair trade advantages.

On the economic front, data indicated that advance retail sales in the US rebounded more-than-anticipated by 0.6% on a monthly basis in March, rising for the first time in 4 months, thus easing concerns that consumer spending, a key driver of economic growth, could act as a drag on the world’s largest economy in the first quarter of 2018. In the prior month, advance retail sales had recorded a drop of 0.1%, while investors had envisaged for an advance of 0.4%. Additionally, the nation’s business inventories climbed 0.6% on a monthly basis in February, meeting market expectations and compared to a similar rise in the prior month.

On the other hand, the US NAHB housing market index recorded an unexpected drop to a level of 69.0 in April, deteriorating for the fourth consecutive month and confounding market consensus for the index to remain steady at a level of 70.0. Further, the nation’s New York Empire State manufacturing index declined to a level of 15.8 in April, after recording a reading of 22.5 in the previous month. Market participants had expected the index to drop to a level of 18.4.

In the Asian session, at GMT0300, the pair is trading at 1.2382, with the EUR trading flat against the USD from yesterday’s close.

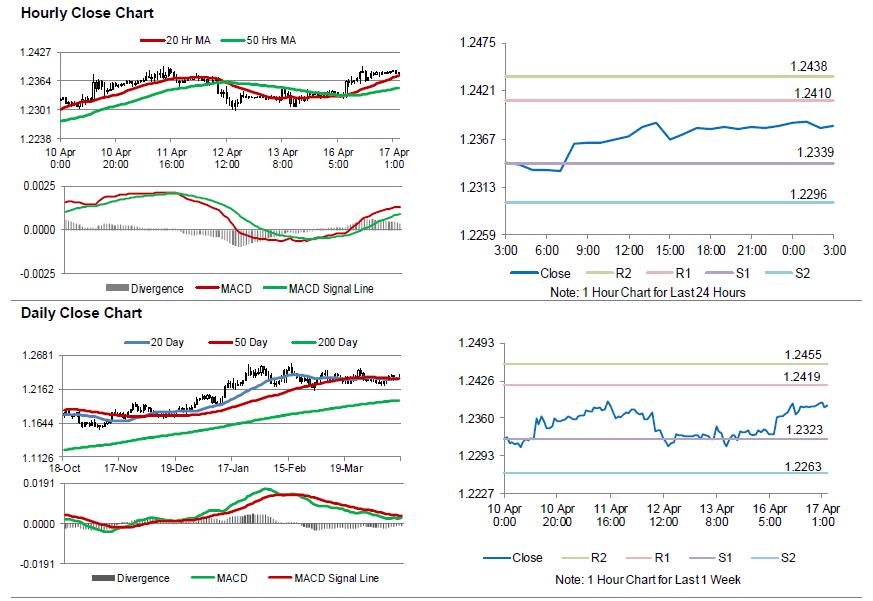

The pair is expected to find support at 1.2339, and a fall through could take it to the next support level of 1.2296. The pair is expected to find its first resistance at 1.2410, and a rise through could take it to the next resistance level of 1.2438.

Ahead in the day, traders would keep a close watch on the ZEW economic sentiment survey data, scheduled to release across the Euro-zone in a few hours. Moreover, the US housing starts, building permits, industrial as well as manufacturing production data, all for March, slated to release later today, will keep investors on their toes.

The currency pair is showing convergence with its 20 Hr moving average and trading above its 50 Hr moving average.