For the 24 hours to 23:00 GMT, the EUR declined 0.77% against the USD and closed at 1.1131, after Greece missed the deadline for a €1.6 billion payment and become the first developed economy to default on a loan with the IMF.

In other economic news, the preliminary estimate of the Euro-zone’s CPI advanced 0.20% YoY in June, at par with market estimates, compared to a rise of 0.30% in the previous month, while the jobless rate remained unchanged at 11.1% in May.

Other economic data showed that Germany’s jobless rate stood at 6.4% in June, unchanged from May. Meanwhile, retail sales of the nation rose 0.50% MoM, against market expectations of 0.2% increase, in May and compared to a revised rise of 1.30% in the prior month, indicating that recovery in Euro-zone’s biggest economy stayed on track.

In the US, the consumer confidence index surged to a reading of 101.4 in June from 95.4 in May, while markets expected it to rise to 97.1, while the Chicago PMI climbed to 49.40 in June, compared to market expectations of a rise to 50.60. In the prior month, the index had recorded a reading of 46.20.

In the Asian session, at GMT0300, the pair is trading at 1.1139, with the EUR trading 0.07% higher from yesterday’s close.

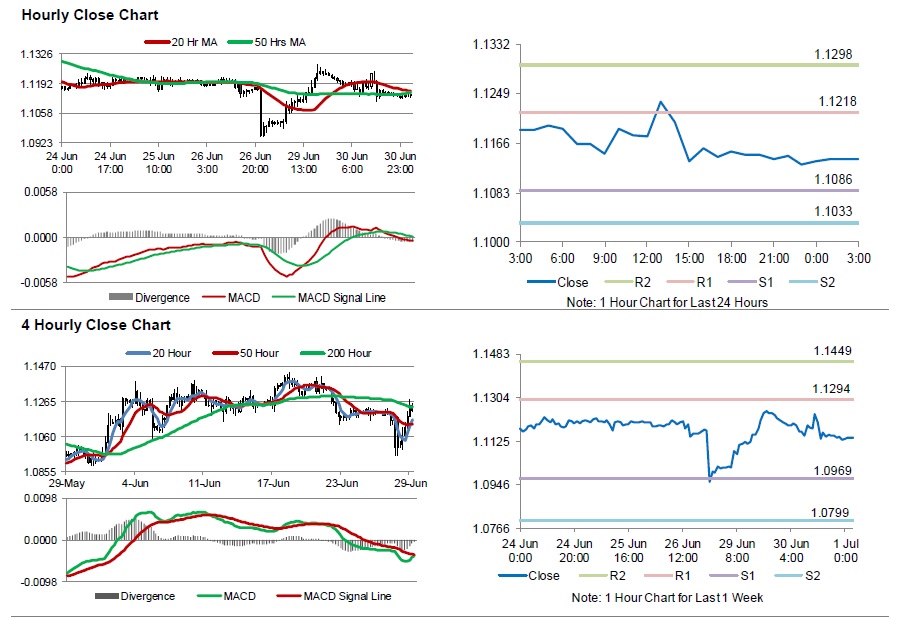

The pair is expected to find support at 1.1086, and a fall through could take it to the next support level of 1.1033. The pair is expected to find its first resistance at 1.1218, and a rise through could take it to the next resistance level of 1.1298.

Trading trends in the Euro today are expected to be determined by manufacturing PMI data of Euro-zone and its peripheries, scheduled in a few hours. Additionally, the US ISM manufacturing PMI would grab a lot of market attention, scheduled later today.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.