For the 24 hours to 23:00 GMT, the EUR rose 0.14% against the USD and closed at 1.1110, as the Euro-zone’s manufacturing activity expanded at the fastest pace in 13 months in May.

Data released showed that the Euro-zone’s preliminary manufacturing PMI advanced unexpectedly to 52.30 in May, compared to a reading of 52.00 in the prior month. On the other hand, the Euro-zone’s services PMI eased to 53.30 in May lower than market expectations of a fall to a level of 53.90.

In other economic news, the flash manufacturing PMI in Germany eased to a level of 51.40, compared to market expectations of a drop to a level of 52.00, while the preliminary services PMI recorded a drop to 52.90, in May, compared to a level of 54.00 in the prior month. Markets were anticipating the nation’s services PMI to ease to 53.90. Meanwhile, the consumer confidence index in the Euro-zone eased to -5.50 in May, compared to market expectations of a drop to a level of -4.80. The index had registered a reading of -4.60 in the prior month.

Separately, the ECB Chief, Mario Draghi stated that growth as well as inflation remained low everywhere in Europe, despite economic conditions improving somewhat in Europe.

The greenback lost ground, after data indicated that the number of US citizens claiming unemployment benefits for the first time increased to 274,000 in the week ended 16 May. The fresh figure missed the expectations of a milder hike to 270,000 from 264,000 registered in the prior week. Additionally, existing home sales in the US surprisingly declined 3.3% in April, following a revised increase of 6.5% in the previous month.

The US Dollar further came under pressure, as the preliminary estimate of the nation’s manufacturing PMI unexpectedly tumbled to a sixteen-month low reading of 53.8 in May, lower than market expectations of a rise to a level of 54.50.

In the Asian session, at GMT0300, the pair is trading at 1.113, with the EUR trading 0.19% higher from yesterday’s close.

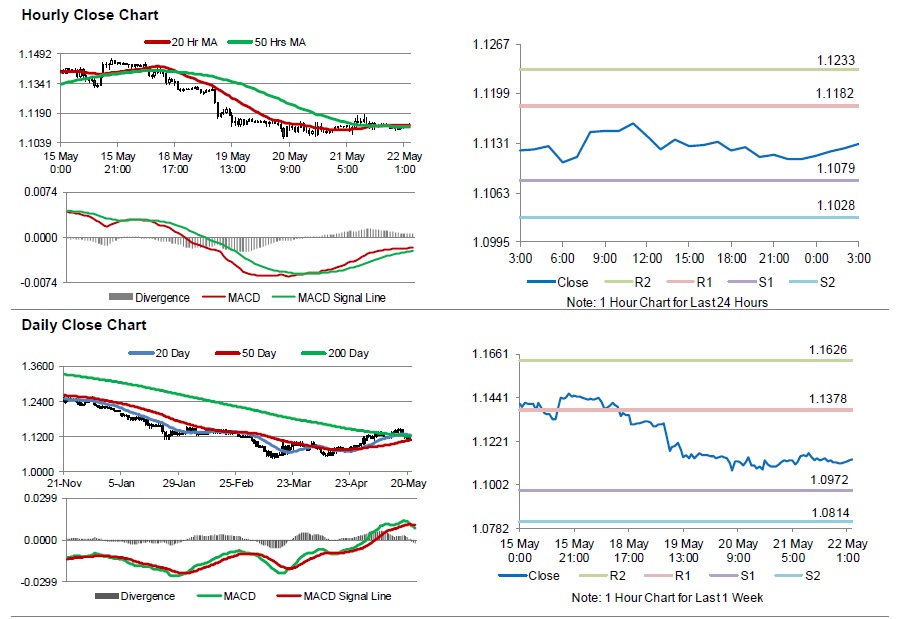

The pair is expected to find support at 1.1079, and a fall through could take it to the next support level of 1.1028. The pair is expected to find its first resistance at 1.1182, and a rise through could take it to the next resistance level of 1.1233.

Trading trends in the pair today are expected to be determined by the final estimate of Germany’s Q1 GDP along with the nation’s IFO survey data, scheduled in a few hours. Additionally, the US CPI data, scheduled later today will be closely watched, given its influence in determining the Fed’s monetary policy stance.

The currency pair is showing convergence with its 20 Hr and 50 Hr moving averages.