For the 24 hours to 23:00 GMT, the EUR declined 0.14% against the USD and closed at 1.0915.

On the macro front, Germany’s seasonally adjusted trade surplus unexpectedly widened to €21.6 billion in February, compared to a revised surplus of €18.7 billion in the prior month.

In the US, the producer price index advanced 0.7% on an annual basis in March, more than market consensus for a rise of 0.5% and compared to an advance of 1.3% in the prior month. Meanwhile, seasonally adjusted initial jobless claims declined to 6606.0K on weekly basis in week ended 03 April 2020, less than market expectations and compared to a revised reading of 6867.0K in the previous week. Moreover, the Michigan consumer sentiment index decreased to a level of 71.0 in April, more than market consensus for drop to 75.0 and compared to a reading of 89.1 in the prior month. Furthermore, the consumer price index dropped 0.4% on a monthly basis in March, surpassing market expectations for a drop of 0.3% and compared to a rise of 0.1% in the earlier month.

Separately, Federal Reserve (Fed) Chairman, Jerome Powell, in his speech, stated that the US central bank was committed to using all its powers “forcefully, pro-actively, and aggressively” until it believes that the economy is on the road to recovery. Additionally, he believes that the country’s economic recovery could be robust despite the sharp slowdown caused by the coronavirus-induced shutdown. He also reiterated that the Fed’s decision to keep borrowing costs low to stabilise the economy and subdue the virus would continue.

In the Asian session, at GMT0300, the pair is trading at 1.0948, with the EUR trading 0.30% higher against the USD from yesterday’s close.

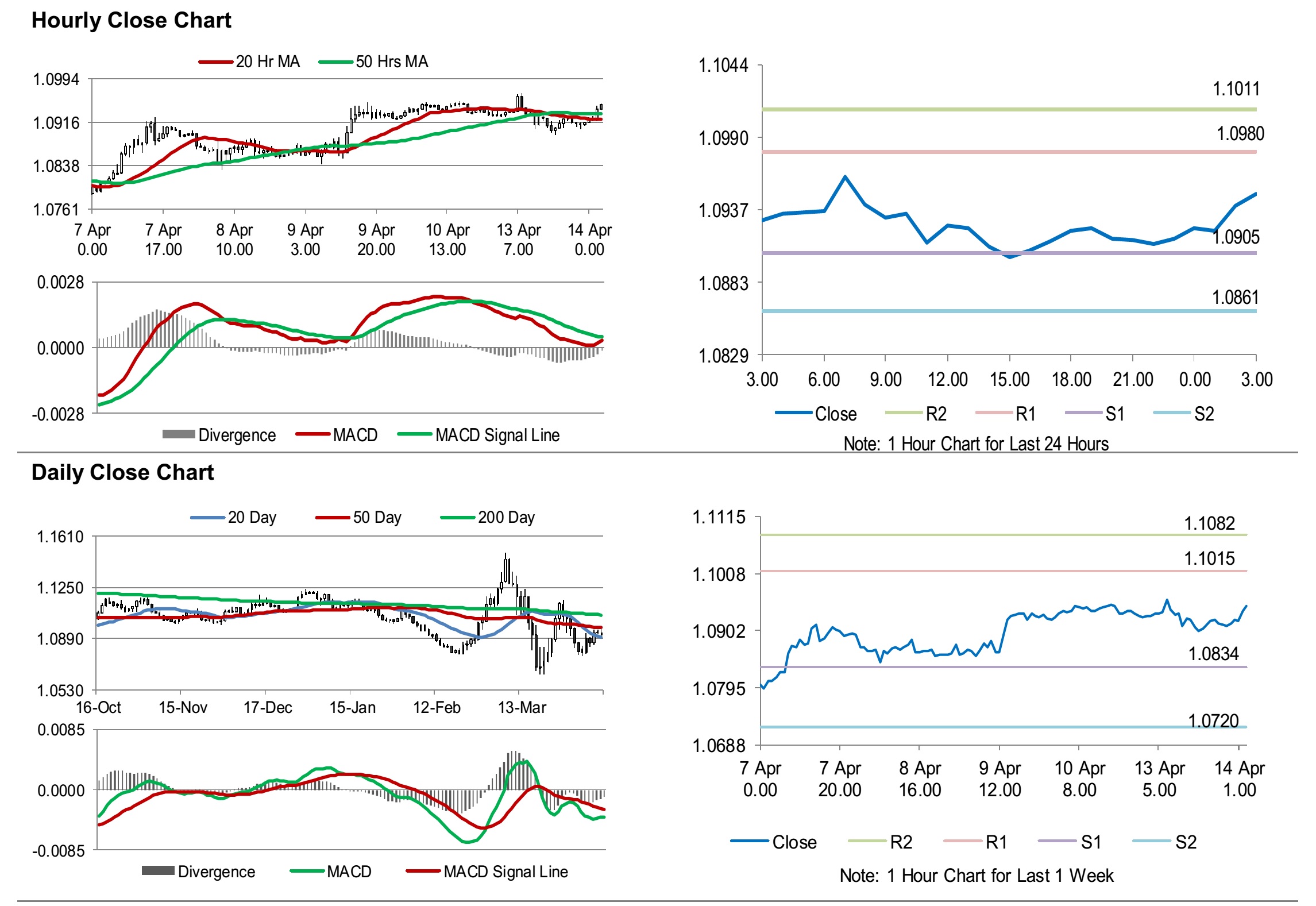

The pair is expected to find support at 1.0905, and a fall through could take it to the next support level of 1.0861. The pair is expected to find its first resistance at 1.0980, and a rise through could take it to the next resistance level of 1.1011.

Amid lack of major macroeconomic releases in the Euro-zone and US today, investor sentiment would be governed by global macroeconomic events.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.