For the 24 hours to 23:00 GMT, the EUR declined 0.67% against the USD and closed at 1.1223.

In economic news, the Euro-zone’s producer price index (PPI) slid 0.10% on a monthly basis in July, meeting market anticipations.

In the US, the ADP indicated that private sector employment in the nation registered an increase of 190.00 K in August, compared to a revised increase of 177.00 K in the previous month, but fell short of expectations as markets anticipated it to advance 200.00 K.

Other economic data revealed that US factory orders in the 0.40% in July on a MoM basis, lower than market expectations for a rise of 0.90%. In the prior month, factory orders had risen by a revised 2.20%.

Separately, the Fed’s Beige Book revealed that the US economy will maintain its “modest-moderate” pace of economic growth in the coming months. Meanwhile, it indicated that sluggish wage growth could hamper the US central bank’s decision about the interest rate decision at its upcoming monetary policy meeting scheduled on 16-17 September.

In the Asian session, at GMT0300, the pair is trading at 1.1216, with the EUR trading 0.06% lower from yesterday’s close.

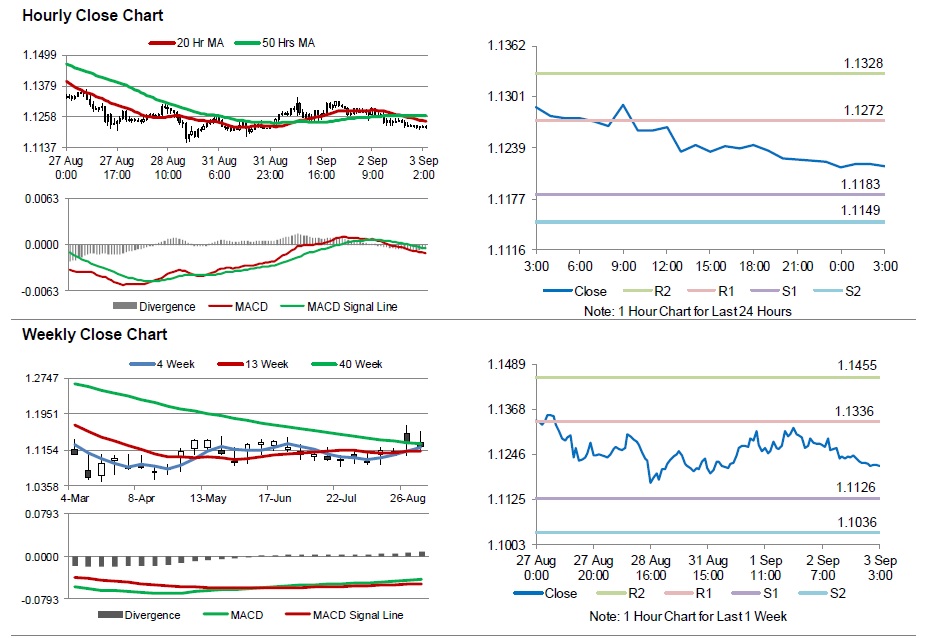

The pair is expected to find support at 1.1183, and a fall through could take it to the next support level of 1.1149. The pair is expected to find its first resistance at 1.1272, and a rise through could take it to the next resistance level of 1.1328.

Trading trends in the Euro today are expected to be determined by the ECB’s interest rate decision, scheduled later today. Meanwhile, investors would keep a close eye on the US ISM non-manufacturing PMI as well as initial jobless claims data, scheduled in the later part of the day.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.