For the 24 hours to 23:00 GMT, the EUR rose 0.69% against the USD and closed at 1.1298, as the Euro-zone’s unemployment rate slipped to its lowest level in three years in July.

Data showed that the jobless rate in the common-currency union unexpectedly fell to 10.9% in July from 11.1% the month before.

Elsewhere, the German unemployment rate remained steady at 6.4% in August, at par with market expectations. However, number of unemployed people in the nation slid 7.00 K in August, compared to a revised rise of 8.00 K in the prior month, while markets expected it to ease 4.00 K.

Other economic data showed that Germany’s final manufacturing PMI rose to 53.30 in August, compared to market expectations of a rise to 53.20. On the other hand, the Euro-zone’s final manufacturing PMI fell unexpectedly to 52.30 in August, lower than market forecasts of an unchanged reading from its previous month.

The greenback came under pressure, after the US ISM manufacturing PMI weakened more than expected to a level of 51.1 in August, from prior month’s reading of 52.7 in July, thereby pointing to worries that the Fed may delay its plan of increasing interest rates.

Other economic data showed that construction spending in the US climbed 0.70% on a MoM basis in July, more than market expectations for an advance of 0.60%.

Separately, the Boston President, Eric Rosengren, in a speech, mentioned that weaker global economy would increase the uncertainty surrounding nation’s economic growth and inflation forecasts and favoured being cautious about tightening the monetary policy. Further he stated that the central bank would hike the interest rates at a gradual pace.

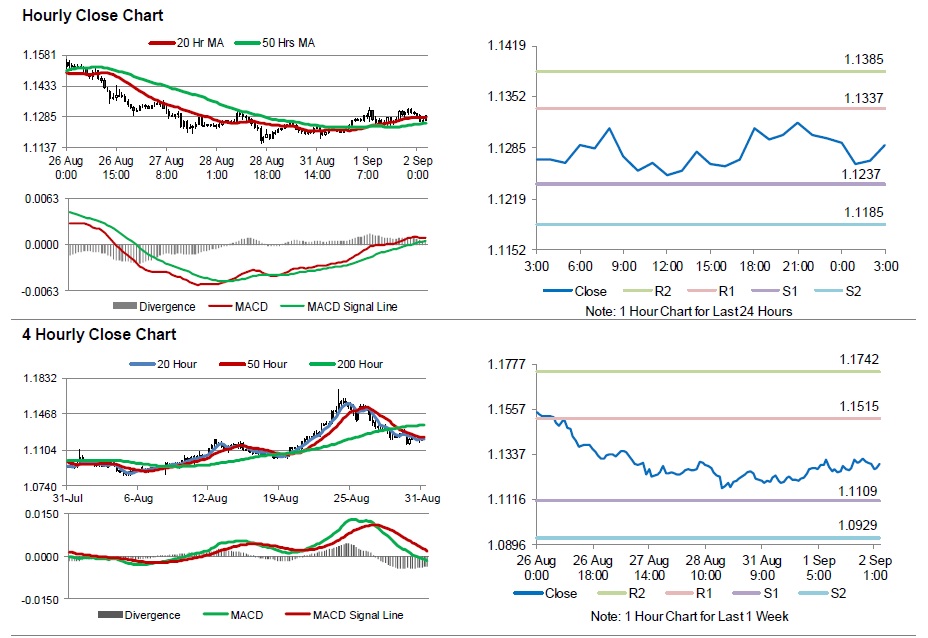

In the Asian session, at GMT0300, the pair is trading at 1.1289, with the EUR trading 0.08% lower from yesterday’s close.

The pair is expected to find support at 1.1237, and a fall through could take it to the next support level of 1.1185. The pair is expected to find its first resistance at 1.1337, and a rise through could take it to the next resistance level of 1.1385.

Trading trends in the Euro today are expected to be determined by the Euro-zone’s producer prices data, scheduled in a few hours. Additionally, the US ADP employment numbers and factory orders data would grab lot of market attention.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.