For the 24 hours to 23:00 GMT, the EUR traded a tad higher against the USD and closed at 1.1179, following encouraging German retail sales data.

Data revealed that retail sales in Germany jumped 2.9% on a monthly basis, marking a 7-year high in January, higher than market expected rise of 0.4% and compared to prior month’s rise of 0.6%, thus indicating that private consumption would propel growth in the Euro-zone’s biggest economy this year.

Other economic data showed that the producer price index (PPI) in the Euro-zone eased 0.90% MoM in January, compared to a drop of 1.00% in the prior month. Markets were anticipating the index to fall 0.70%.

In the US, the economic optimism index registered a rise to 49.10 in March, compared to a reading of 47.50 in the prior month. Meanwhile, the New York City current business condition index edged up to 63.10 in February, following a level of 44.50 in the previous month.

In the Asian session, at GMT0400, the pair is trading at 1.1171, with the EUR trading 0.07% lower from yesterday’s close.

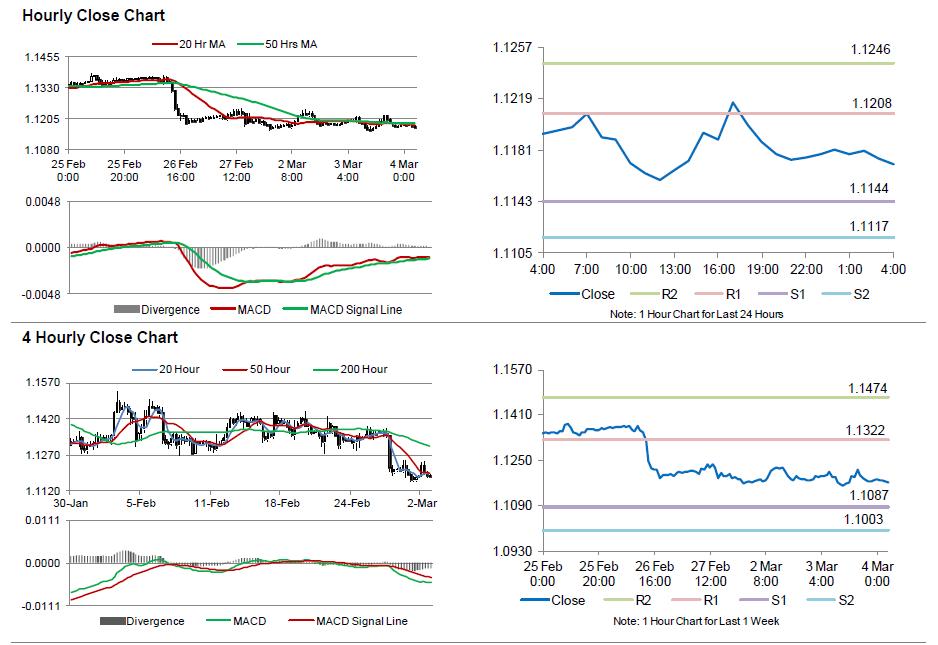

The pair is expected to find support at 1.1144, and a fall through could take it to the next support level of 1.1117. The pair is expected to find its first resistance at 1.1208, and a rise through could take it to the next resistance level of 1.1246.

Trading trends in the Euro today are expected to be determined by the Markit services PMI data from the Euro-zone and its peripheries, scheduled in a few hours. Meanwhile, investors would pay close attention to the US ISM non-manufacturing composite PMI data, scheduled later today.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.