For the 24 hours to 23:00 GMT, the EUR rose 0.35% against the USD and closed at 1.1967.

On the economic front, Italy’s consumer confidence index unexpectedly rose to a level of 110.8 in August, surging to an eight-month high level, while market participants had anticipated it to remain steady at a revised level of 106.9 registered in the prior month.

The greenback lost ground against most of its major peers, as investors remained disappointed after comments from the US Federal Reserve (Fed) Chairwoman, Janet Yellen, in Jackson Hole, provided little indications on the central bank’s monetary policy outlook. Additionally, concerns about how tropical storm, Harvey, might impact the country’s economic growth weighed on investor sentiment.

On the data front, advance goods trade deficit in the US widened more-than-expected to a level of $65.1 billion in July, amid a sharp drop in exports. In the previous month, the nation posted a revised advance goods trade deficit of $64.0 billion, while markets had expected it to widen to a level of $64.5 billion.

On the other hand, the nation’s seasonally adjusted preliminary wholesale inventories registered a rise of 0.4% MoM in July, higher than market consensus for a gain of 0.3% and following an advance of 0.7% in the previous month. Moreover, the nation’s Dallas Fed manufacturing business index climbed to a level of 17.0 in August, meeting market expectations and compared to a reading of 16.8 in the previous month.

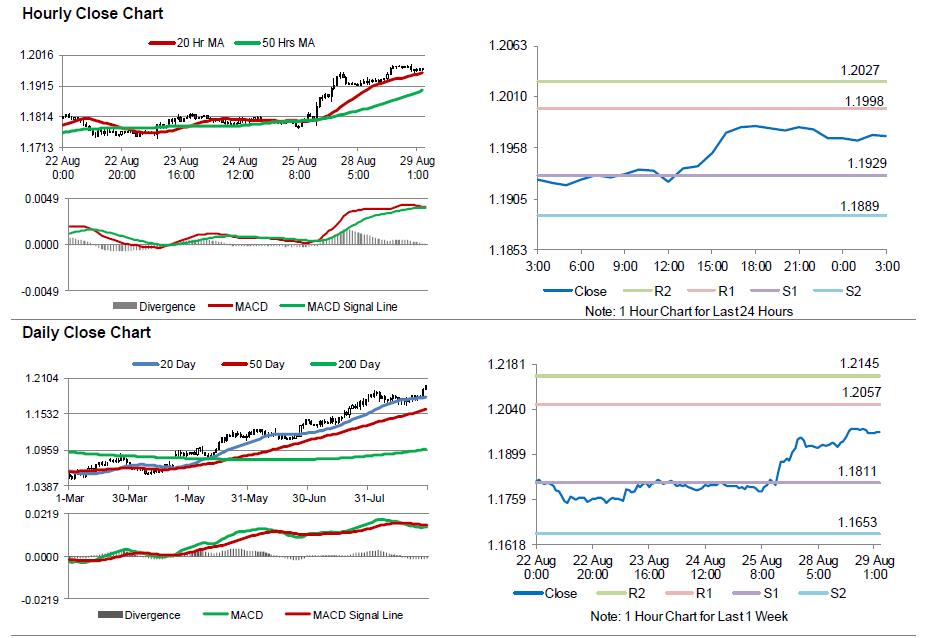

In the Asian session, at GMT0300, the pair is trading at 1.1970, with the EUR trading a tad higher against the USD from yesterday’s close.

The pair is expected to find support at 1.1929, and a fall through could take it to the next support level of 1.1889. The pair is expected to find its first resistance at 1.1998, and a rise through could take it to the next resistance level of 1.2027.

Moving ahead, investors will direct their attention to Germany’s GfK consumer confidence for September, slated to release in a while. Further, the US consumer confidence index for August, due to release later in the day, will be on investors’ radar.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.