For the 24 hours to 23:00 GMT, the EUR declined 0.28% against the USD and closed at 1.0554.

On the data front, industrial production in France rebounded 2.2% on a monthly basis in November, suggesting that economic activity gained momentum in the Euro-zone’s second-largest economy. Markets expected industrial production to advance 0.6%, after recording a revised drop of 0.1% in the previous month.

In the US, the NFIB small business optimism index climbed more-than-expected to a level of 105.8 in December, notching its 12-year high level, as businesses turned increasingly optimistic about the nation’s growth prospects following the Presidential election. The index registered a level of 98.4 in the prior month, whereas investors had envisaged for a rise to a level of 99.5.

Further, the nation’s JOLTs job openings increased to a level of 5522.0K in November, surpassing market expectations of an advance to a level of 5500.0K and after recording a revised reading of 5451.0K in the previous month. Also, the nation’s final wholesale inventories grew better-than-anticipated by 1.0% in November, compared to a rise of 0.9% in the preliminary print and following a revised fall of 0.1% in the prior month.

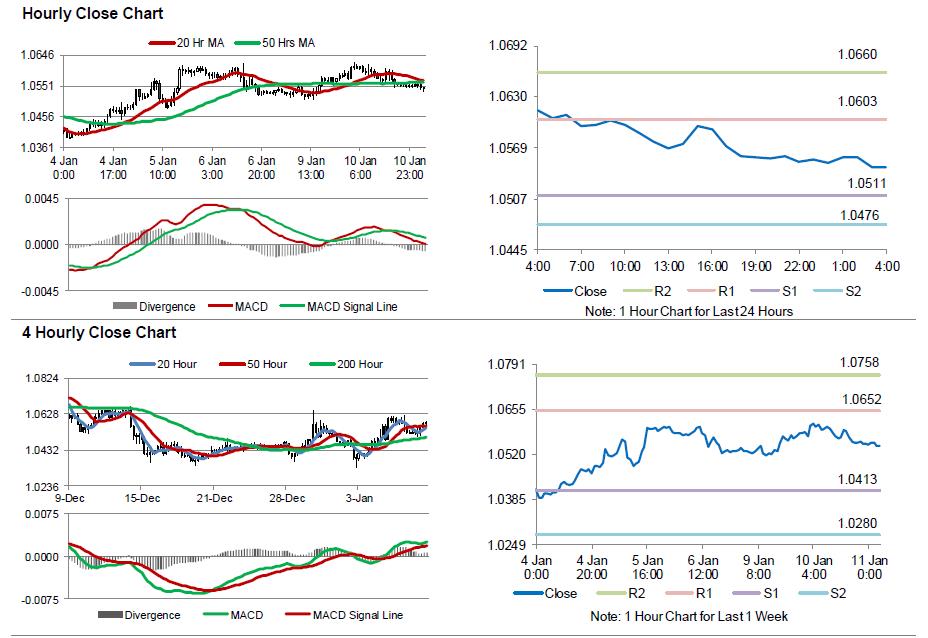

In the Asian session, at GMT0400, the pair is trading at 1.0545, with the EUR trading 0.09% lower against the USD from yesterday’s close.

The pair is expected to find support at 1.0511, and a fall through could take it to the next support level of 1.0476. The pair is expected to find its first resistance at 1.0603, and a rise through could take it to the next resistance level of 1.0660.

Amid a lack of economic releases in the Euro-zone today, investors will look forward to the US MBA mortgage applications data, due for release later today. Also, investors will keenly await the US President-elect Donald Trump’s first news conference, scheduled later today.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.