For the 24 hours to 23:00 GMT, the EUR marginally rose against the USD and closed at 1.1736.

In the US, data indicated that existing home sales climbed more-than-expected by 2.0% on a monthly basis to a level of 5.48 million in October, rising by the most in seven months, as disruptions caused by hurricanes dissipated. In the prior month, existing home sales had recorded a revised level of 5.37 million, while investors had expected for a rise of 5.40 million. Additionally, the nation’s Chicago Fed national activity index unexpectedly advanced to a level of 0.65 in October, notching a more than ten-year high level. The index had registered a revised reading of 0.36 in the previous month, while markets were expecting for a drop to a level of 0.20.

In the Asian session, at GMT0400, the pair is trading at 1.1739, with the EUR trading a tad higher against the USD from yesterday’s close.

Meanwhile, the Federal Reserve (Fed) Chairwoman, Janet Yellen, acknowledged that the US central bank is reasonably close to its goals and expects inflation to pick up over the next couple of years. However, she cautioned that the Fed is “not certain” whether weakness in inflation will prove transitory. Further, Yellen noted that raising interest rates too quickly risked inflation to drift down to dangerously low levels.

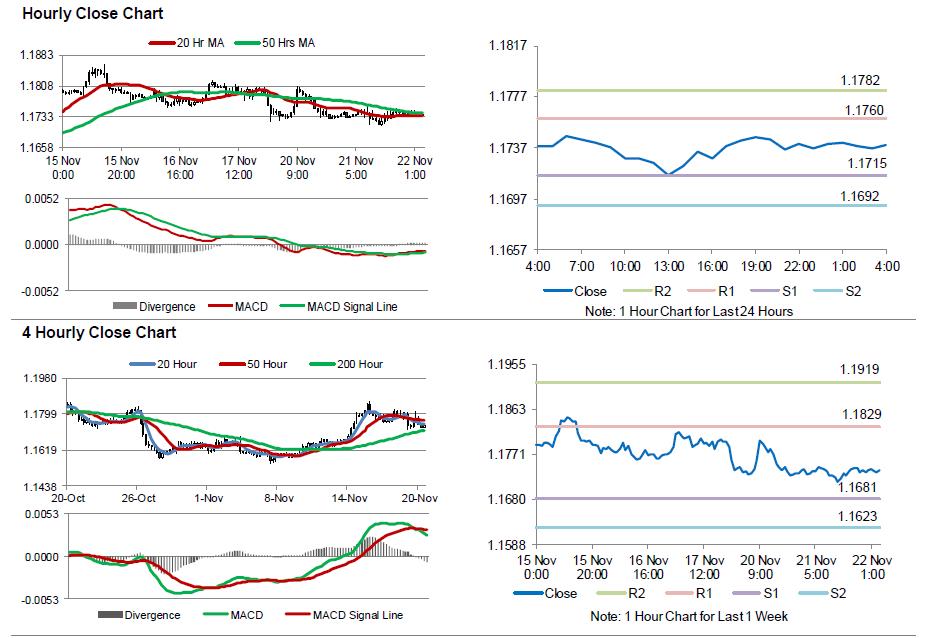

The pair is expected to find support at 1.1715, and a fall through could take it to the next support level of 1.1692. The pair is expected to find its first resistance at 1.1760, and a rise through could take it to the next resistance level of 1.1782.

Moving ahead, investors would focus on the Euro-zone’s flash consumer confidence index for November, slated to release later today. Moreover, minutes from the Federal Reserve’s recent meeting, due to release later in the day, would be closely monitored to get clues on the central bank’s monetary policy trajectory.

The currency pair is showing convergence with its 20 Hr and 50 Hr moving averages.