For the 24 hours to 23:00 GMT, the EUR declined 0.11% against the USD and closed at 1.1202.

The US dollar gained ground against major currencies, after the Fed, at its latest monetary policy meeting, decided to leave its key interest rate at 2.5%, as widely expected, amid hopes for better inflation as well as citing ongoing positive jobs data and economic growth. The central bank Chairman, Jerome Powell, expressed confidence in the decision of the policymakers and reiterated that they are in no rush for a near-term change in monetary policy. Additionally, the Fed slashed its excess reserves interest to 2.35% from 2.40% with a view to assure that the federal funds rate remains in the current target band.

In the US, data indicated that the final Markit manufacturing PMI unexpectedly advanced to a level of 52.60 in April, compared to a level of 52.4 in the preceding month. The preliminary figures and markets had anticipated the PMI to record a steady reading. Further, the nation’s ADP private sector employment climbed 275.0K in April, following a revised gain of 151.0K in the prior month. Market participants had anticipated the private sector employment to record a gain of 180.0K.

On the flipside, the US ISM manufacturing activity index declined to a level of 50.0 in April, compared to market expectations for a fall to a level of 55.0. In the prior month, the ISM manufacturing activity index had recorded a reading of 55.3. Moreover, the nation’s mortgage applications dropped to a six-week low level by 4.3% on a weekly basis in the week ended 26 April 2019, following a decline of 7.3% in the prior week.

In the Asian session, at GMT0300, the pair is trading at 1.1203, with the EUR trading a tad higher against the USD from yesterday’s close.

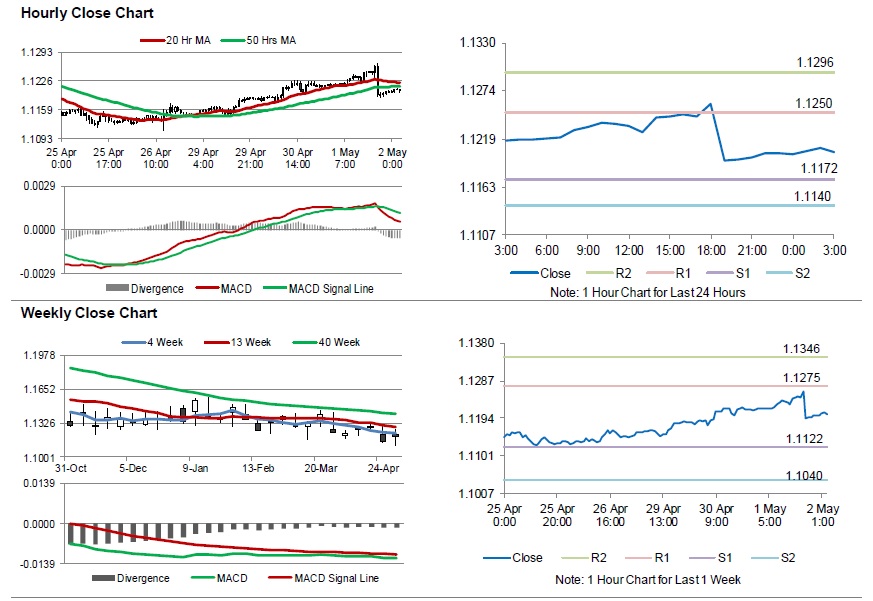

The pair is expected to find support at 1.1172, and a fall through could take it to the next support level of 1.1140. The pair is expected to find its first resistance at 1.1250, and a rise through could take it to the next resistance level of 1.1296.

Moving ahead, traders would keep an eye on the Markit manufacturing PMI for April, set to release across the euro bloc in a few hours. Also, German retail sales for March, set to release in a few hours, will be on investors’ radar. Later in the day, the US nonfarm productivity for the first quarter, durable goods orders and factory orders for March along with initial jobless claims, will keep traders on their toes.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.