For the 24 hours to 23:00 GMT, the EUR declined 0.18% against the USD and closed at 1.0570.

In economic news, German retail sales unexpectedly declined 0.4% MoM in October, against investor expectations for a rise of 0.4%, and after recording a flat reading in the previous month. On the other hand, the nation’s preliminary consumer price inflation advanced as expected by 0.1% MoM in November, compared to a flat reading in the previous month.

In the US, the Chicago purchasing managers index dropped to a level of 48.7 in November, from a reading of 56.2 in the previous month. Investors had expected it to fall to a level of 54.0. Moreover, pending home sales in the US inched up 0.2% MoM in October, disappointing expectations for a gain of 1.0%, and after falling by a revised 1.6% in the previous month. On the other hand, the US Dallas Fed manufacturing business index advanced to a level of -4.9 in November, compared to a reading of -12.7 in the prior month. Markets were expecting the index to rise to a level of -10.0.

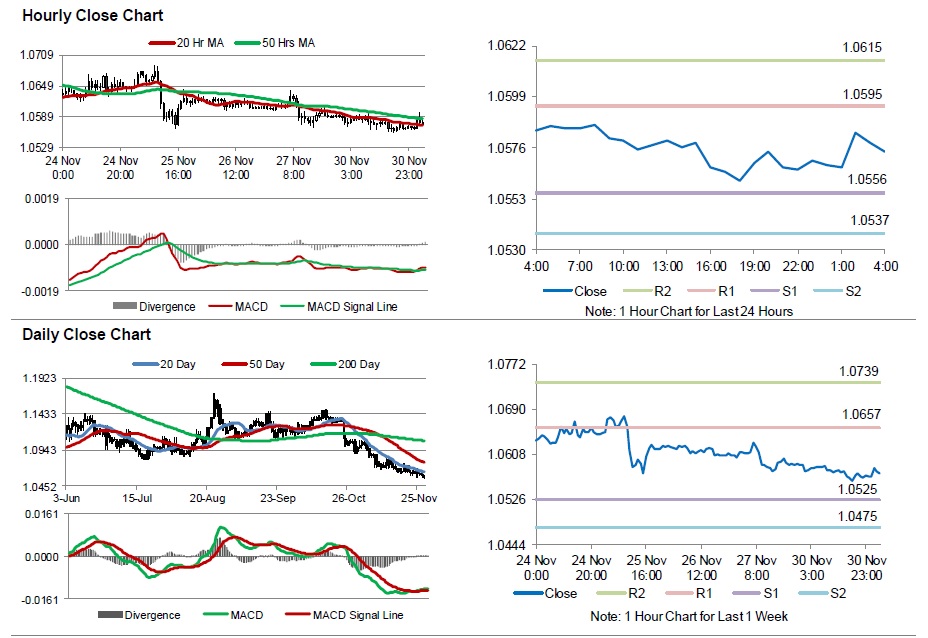

In the Asian session, at GMT0400, the pair is trading at 1.0574, with the EUR trading marginally higher from yesterday’s close.

The pair is expected to find support at 1.0556, and a fall through could take it to the next support level of 1.0537. The pair is expected to find its first resistance at 1.0595, and a rise through could take it to the next resistance level of 1.0615.

Moving ahead, market participants will look forward to the Markit manufacturing PMI and unemployment rate data across the Euro-zone, scheduled to be released in a few hours. Additionally, investors will also concentrate on the US Markit Manufacturing PMI and the ISM Manufacturing PMI data, both for the month of November, due later in the day.

The currency pair is showing convergence with its 20 Hr and 50 Hr moving averages.