For the 24 hours to 23:00 GMT, the EUR rose 0.45% against the USD and closed at 1.1200 on Friday.

Macroeconomic data showed that the Euro-zone’s final consumer price index advanced 1.4% on an annual basis in May, confirming the flash estimate and following a gain of 1.9% in the previous month.

The greenback lost ground against a basket of major currencies on Friday, following downbeat US economic data that raised fresh doubts over the state of the nation’s economy.

The US flash Reuters/Michigan consumer sentiment index dropped more-than-expected to a level of 94.5 in June, suggesting that consumers are losing confidence over the country’s growth prospects amid ongoing political unrest in Washington. In the preceding month, the index had registered a reading of 97.1, while market participants expected for drop to a level of 97.0. Moreover, the nation’s housing starts dipped to an eight-month low level on a monthly basis in May, after it unexpectedly fell 5.5%, to an annual rate of 1092.0K, compared to a revised reading of 1156.0K in the previous month. Markets were expecting housing starts to rise to a level of 1220.0K. Further, the nation’s building permits surprisingly eased 4.9% MoM, to an annual rate of 1168.0K in May, while investors had envisaged it to climb to a level of 1249.0K and following a revised reading of 1228.0K in the previous month. Also, the nation’s labour market conditions index declined more-than-expected to a level of 2.3 in May, compared to a revised reading of 3.7 in the previous month.

In the Asian session, at GMT0300, the pair is trading at 1.1196, with the EUR trading slightly lower against the USD from Friday’s close.

Over the weekend, the French President, Emmanuel Macron, won a decisive majority in French parliamentary elections.

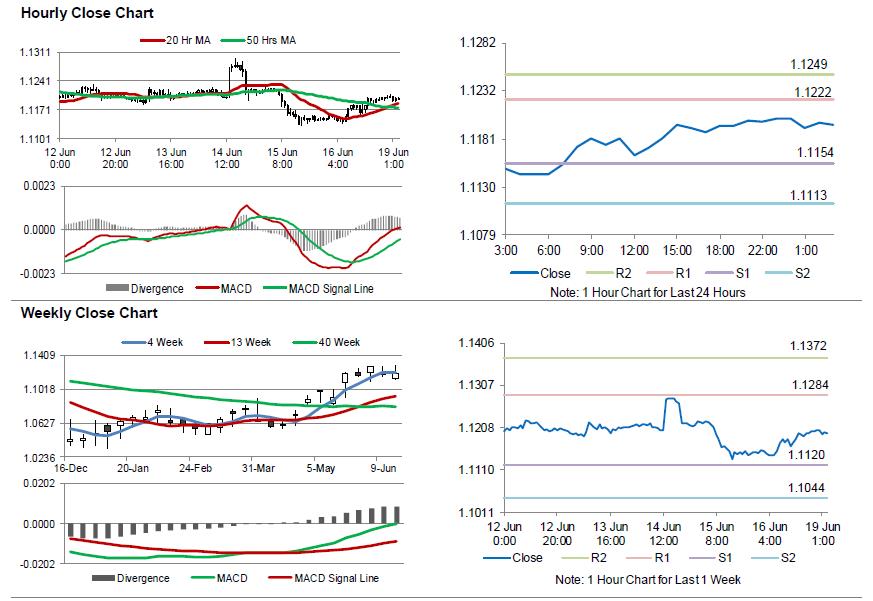

The pair is expected to find support at 1.1154, and a fall through could take it to the next support level of 1.1113. The pair is expected to find its first resistance at 1.1222, and a rise through could take it to the next resistance level of 1.1249.

Going ahead, investors will look forward to the Euro-zone’s construction output data for April, slated to release in a few hours. Moreover, in the US, a speech by William Dudley, due later in the day, will be on investors’ radar.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.