For the 24 hours to 23:00 GMT, the EUR declined 0.2% against the USD and closed at 1.2196, after data revealed that annual inflation in the Euro-zone slowed in February.

The Euro-zone’s flash consumer price index (CPI) advanced 1.2% on an annual basis in February, in line with market expectations and rising at its weakest pace since December 2016, thus justifying the European Central Bank’s cautious approach in unwinding its policy stimulus, despite growth exceeding expectations. In the previous month, the CPI had registered a rise of 1.3%.

Separately, Germany’s seasonally adjusted unemployment rate remained steady at a record low of 5.4% in February, as widely expected. On the contrary, the nation’s GfK consumer confidence index dropped more-than-estimated to a level of 10.8 in March, compared to market expectations for a fall to a level of 10.9. In the prior month, the index had registered a reading of 11.0.

In economic news, the second estimate of US annualised gross domestic product (GDP) was revised lower to 2.5% on a quarterly basis in the final three months of 2017, compared to a rise of 3.2% in the prior quarter. The preliminary figures had recorded a rise of 2.6%. Moreover, the nation’s pending home sales unexpectedly fell 4.7% on a monthly basis in January, hitting its the lowest reading since October 2014. Market anticipation was for pending home sales to rise 0.5%, following a revised flat reading in the previous month.

Other data revealed that the US Chicago Fed purchasing managers index eased more-than-anticipated to a level of 61.9 in February, marking a 6-month low level. The index had posted a level of 65.7 in the prior month, while investors had envisaged for a drop to a level of 64.1. On the other hand, the nation’s MBA mortgage applications rebounded 2.7% in the week ended 23 February, compared to a fall of 6.6% in the prior week.

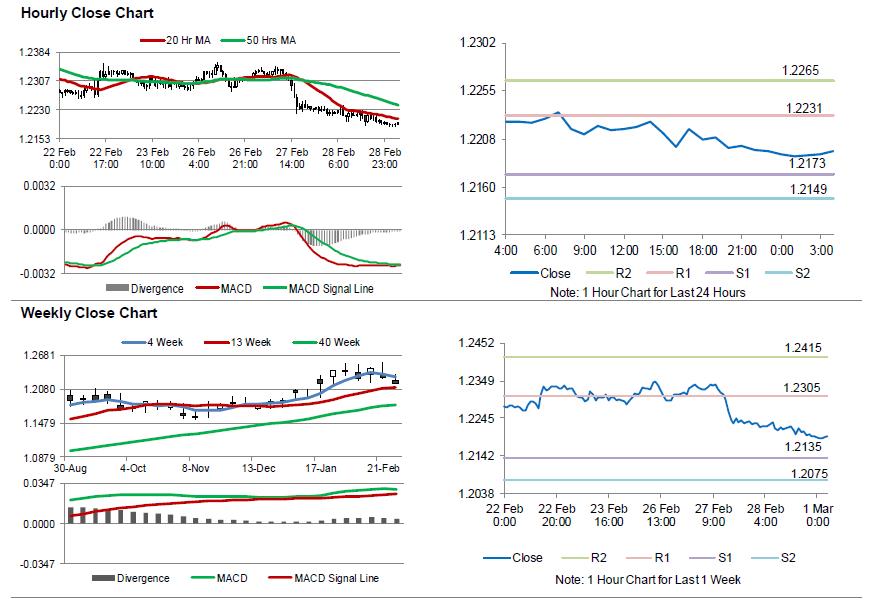

In the Asian session, at GMT0400, the pair is trading at 1.2196, with the EUR trading flat against the USD from yesterday’s close.

The pair is expected to find support at 1.2173, and a fall through could take it to the next support level of 1.2149. The pair is expected to find its first resistance at 1.2231, and a rise through could take it to the next resistance level of 1.2265.

Going ahead, traders would keep a close watch on the final Markit manufacturing PMI for February, scheduled to release across the Euro-zone. Additionally, the region’s unemployment rate data for January, will also be eyed by traders. Later in the day, the US initial jobless claims, personal income and spending data, both for January, followed by the ISM and the final Markit manufacturing PMIs for February as well as construction spending data for January, all would garner a lot of market attention.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.