For the 24 hours to 23:00 GMT, the EUR slightly rose against the USD and closed at 1.1957.

On the economic front, the Euro-zone’s final consumer price index (CPI) rose to a four-month high of 1.5% on an annual basis in August, confirming the preliminary print. In the previous month, the CPI had risen 1.3%.

Separately, according to the Bundesbank monthly report, Germany’s consumer price inflation is likely to retreat in the autumn, due to the “base effects” of sharp increases a year earlier.

Macroeconomic data released in the US indicated that the NAHB housing market index unexpectedly fell to a level of 64.0 in September, amid concerns that Hurricane Harvey as well as Irma will lead to higher material costs and shortage of labour. Investors had envisaged the index to remain steady at a revised reading of 67.0.

In the Asian session, at GMT0300, the pair is trading at 1.1965, with the EUR trading 0.07% higher against the USD from yesterday’s close.

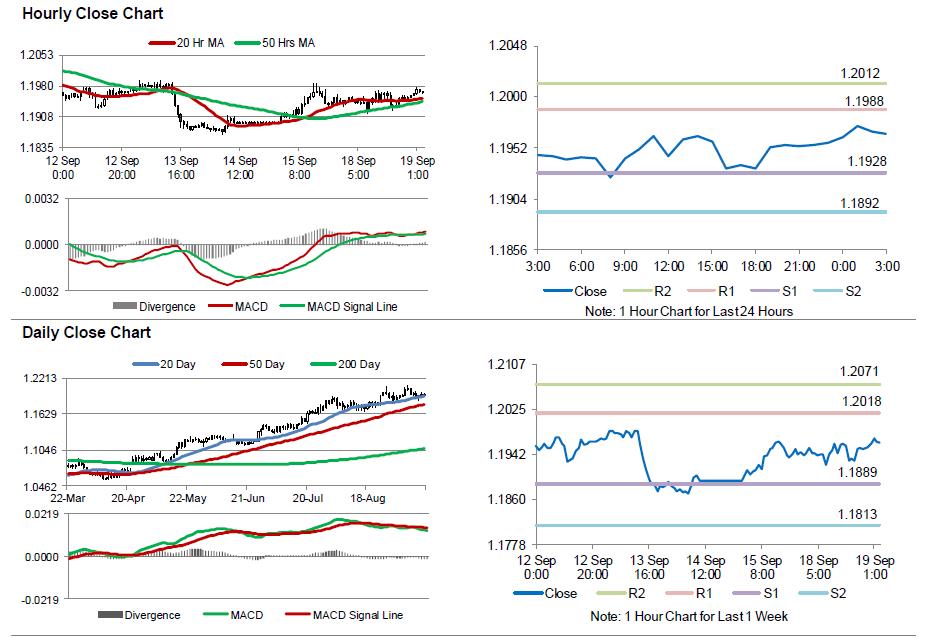

The pair is expected to find support at 1.1928, and a fall through could take it to the next support level of 1.1892. The pair is expected to find its first resistance at 1.1988, and a rise through could take it to the next resistance level of 1.2012.

Going ahead, market participants will focus on the release of ZEW expectations survey for September across the Euro-zone along with the region’s construction output data for July, slated to release in a few hours. Additionally, the US housing starts and building permits data, both for August, set to release later in the day, will attract significant amount of market attention.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.