For the 24 hours to 23:00 GMT, the EUR declined slightly against the USD and closed at 1.2417.

Macroeconomic data showed that the Euro-zone’s flash consumer price index (CPI) rose 1.3% on an annual basis in January, meeting market expectations, recording its weakest growth rate since July 2017, thus stoking fears that stubbornly low inflation might continue to bother policymakers in 2018. The CPI had recorded a gain of 1.4% in the prior month. Nevertheless, the region’s unemployment rate remained steady at a 9-year low of 8.7% in December, meeting market expectations.

Separately, Germany’s seasonally adjusted unemployment rate eased to a fresh record low of 5.4% in January, in line with market expectations, pointing to continuous tightening in the domestic labour market. Unemployment rate had posted a reading of 5.5% in the prior month. On the contrary, the nation’s retail sales retreated more-than-anticipated by 1.9% on a monthly basis in December, compared to a revised increase of 1.8% in the prior month, while markets were anticipating retail sales to ease 0.4%.

The US Dollar initially gained ground against its major peers, after the Federal Reserve (Fed), at its January monetary policy meeting, provided an upbeat view on inflation, spurring speculation that the central bank will pick up the pace of interest-rate hikes this year.

The Federal Open Market Committee (FOMC), in a widely expected move, voted unanimously to leave the benchmark interest rates unchanged in a range of 1.25% to 1.50%. In a statement post-meeting, the central bank stated that it expects sluggishly low inflation to finally pick-up this year and to stabilise around its 2.0% goal. Further, the central bank hinted at further gradual monetary policy tightening, as the world’s largest economy is growing at a robust pace and the labour market continues to improve.

On the macro front, ADP’s private sector employment in the US climbed by 234.0K in January, exceeding market expectations for an advance of 185.0K, thus underscoring strength of the labour market. The private sector employment had recorded a revised increase of 242.0K in the previous month. Moreover, the nation’s pending home sales grew 0.5% on a monthly basis in December, meeting market expectations and rising for the third straight month. In the previous month, pending home sales had climbed by a revised 0.3%.

On the other hand, the nation’s Chicago Fed PMI fell less-than-estimated to a level of 65.7 in January, compared to market expectations for a drop to a level of 64.0. The PMI had recorded a revised level of 67.8 in the previous month. Additionally, the nation’s MBA mortgage applications declined 2.6% in the week ended 26 January. In the previous week, mortgage applications had climbed 4.5%.

In the Asian session, at GMT0400, the pair is trading at 1.2424, with the EUR trading 0.06% higher against the USD from yesterday’s close.

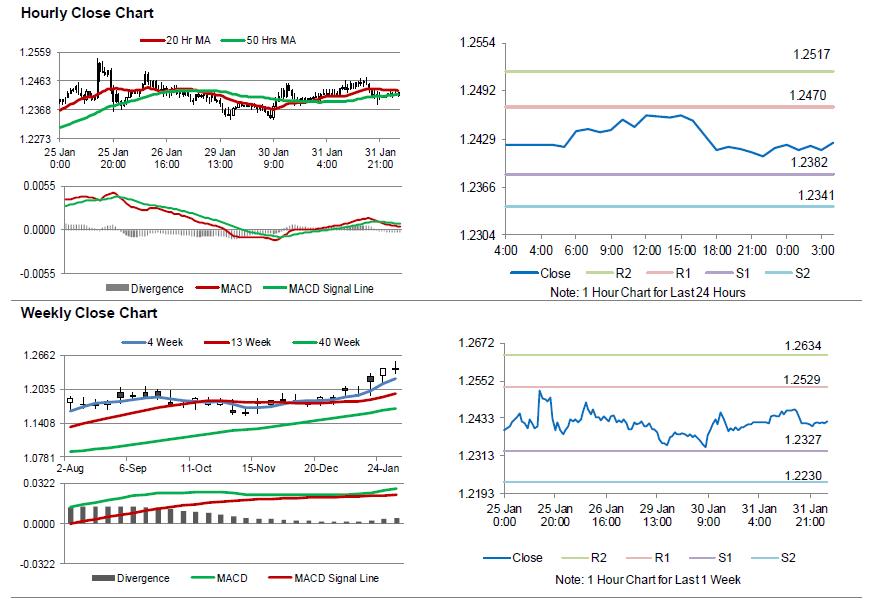

The pair is expected to find support at 1.2382, and a fall through could take it to the next support level of 1.2341. The pair is expected to find its first resistance at 1.2470, and a rise through could take it to the next resistance level of 1.2517.

Looking forward, traders would keep a close watch on the release of final Markit manufacturing PMI for January across the Euro-zone, scheduled in a few hours. Additionally, the US initial jobless claims, followed by the ISM manufacturing and the final Markit manufacturing PMIs for January, as well as construction spending data for December, would keep investors on their toes.

The currency pair is trading below its 20 Hr moving average and showing convergence with its 50 Hr moving average.