For the 24 hours to 23:00 GMT, the EUR declined 0.08% against the USD and closed at 1.1815, dragged by political turmoil in the Euro-zone’s third largest economy, Italy.

On the economic front, the Euro-zone’s final consumer price index (CPI) advanced 1.2% on an annual basis in April, confirming the preliminary print. The CPI had registered a rise of 1.3% in the previous month.

Separately, final reading of German consumer prices recorded a rise of 1.6% on an annual basis in April, confirming the preliminary print and compared to a similar rise in the prior month.

Macroeconomic data released in the US indicated that housing starts declined 3.7% on a monthly basis, to an annual rate of 1287.0K in April, more than market consensus for a fall to a level of 1310.0K. Housing starts had recorded a revised reading of 1336.0K in the previous month. Also, the nation’s building permits eased less-than-anticipated by 1.8% on a monthly basis, to an annual rate of 1352.0K in April, compared to market consensus for a fall to a level of 1350.0K. Building permits had recorded a revised level of 1377.0K in the prior month.

On the other hand, the nation’s industrial production climbed 0.7% MoM in April, exceeding market expectations for a rise of 0.6% and rising for the third straight month. In the prior month, industrial production had registered a revised similar rise. Moreover, the nation’s manufacturing production climbed 0.5% on a monthly basis in April, in line with market expectations. In the previous month, manufacturing production had recorded a revised flat reading.

In the Asian session, at GMT0300, the pair is trading at 1.1833, with the EUR trading 0.15% higher against the USD from yesterday’s close.

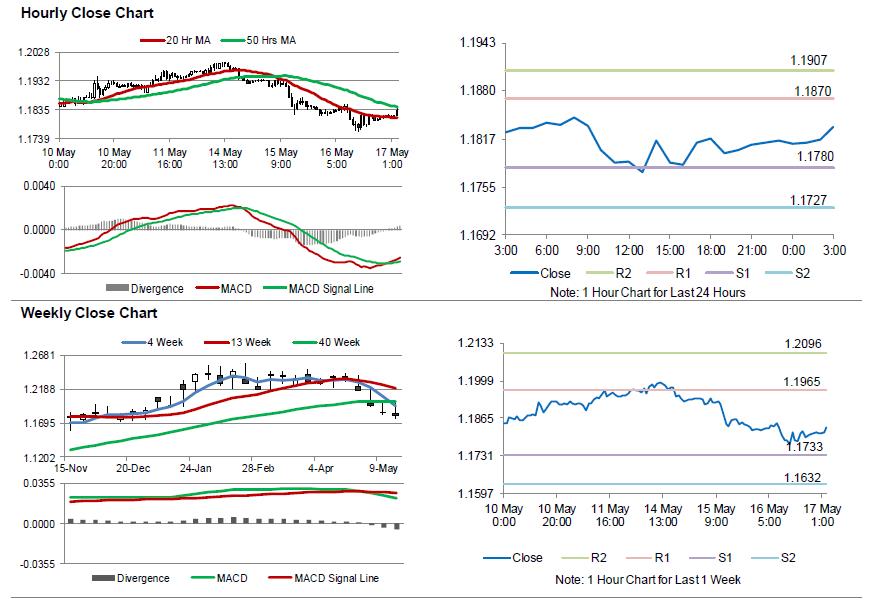

The pair is expected to find support at 1.1780, and a fall through could take it to the next support level of 1.1727. The pair is expected to find its first resistance at 1.1870, and a rise through could take it to the next resistance level of 1.1907.

Moving ahead, investors would look forward to the Euro-zone’s construction output data for March, set to release in a few hours. Additionally, the US initial jobless claims, followed by Philadelphia Fed business outlook survey for May and leading index for April, all slated to release later in the day, will be on investors’ radar.

The currency pair is trading between its 20 Hr and 50 Hr moving averages.