For the 24 hours to 23:00 GMT, the EUR declined 0.12% against the USD and closed at 1.2298 on Friday, after data confirmed that annual inflation in the Euro-zone slowed in January.

The Euro-zone’s final consumer price index (CPI) rose 1.3% on an annual basis in January, confirming the preliminary print, thus indicating that inflation is shifting further away from the European Central Bank’s (ECB) goal of just under 2.0%. In the previous month, the CPI had advanced 1.4%.

Separately, Germany’s seasonally adjusted final gross domestic product (GDP) climbed 0.6% on a quarterly basis in the fourth quarter of 2017, in line with the flash print. The nation’s GDP had recorded a rise of 0.8% in the previous quarter.

On Friday, the Federal Reserve (Fed), in its semi-annual Monetary Policy Report to the Congress, indicated that officials expect the ongoing strength in the US economy to warrant further gradual increases in the federal funds rate. Further, policymakers highlighted a pickup in inflation towards the end of last year.

In the Asian session, at GMT0400, the pair is trading at 1.2310, with the EUR trading 0.1% higher against the USD from Friday’s close.

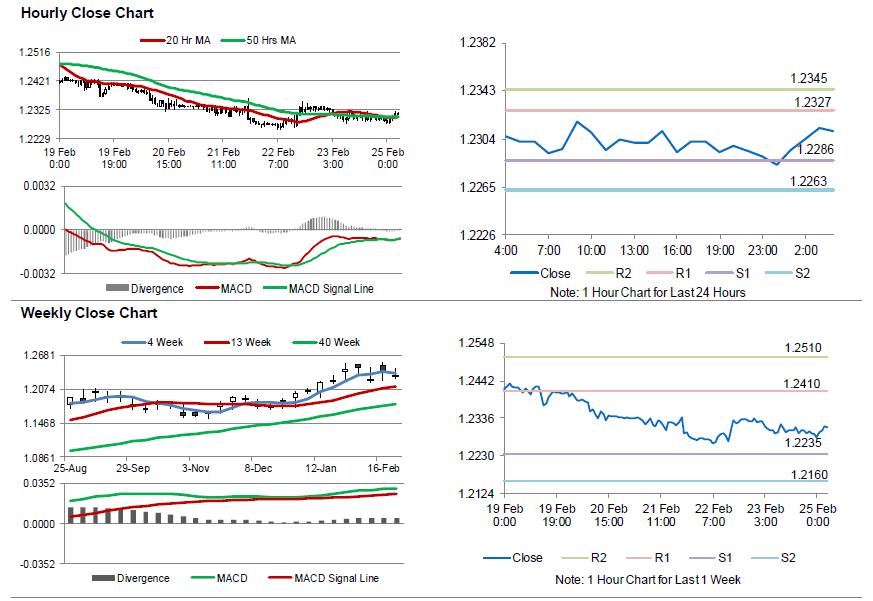

The pair is expected to find support at 1.2286, and a fall through could take it to the next support level of 1.2263. The pair is expected to find its first resistance at 1.2327, and a rise through could take it to the next resistance level of 1.2345.

Moving ahead, market participants would closely monitor a speech by the ECB President, Mario Draghi, due in a few hours. Additionally, the US new home sales data for January, slated to release later in the day, will be on investors’ radar.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.